6 January 2023, 9:28

Tagline

6 January 2023, 9:28

Tagline

New Year’s predictions are like the weather forecast! At DX we took the time to sit down and think about the AML Compliance New Year’s Predictions 2023. The world and the impact around us have led us to 6 Key Trends in 2023.

In our previous predictions 2021, we focused on the Fintechization and AML as a global priority. In 2023 we think the world due to economic impact and the fact that still a key majority of our world is underbanked (Fintech enables Financial Inclusion). This is why we at DX Compliance believe in 6 key trends that will shape 2023

2023 is not much different from 2022 as it faces the same difficulties that compliance Officers have experienced as they try to plan for the future.

Competing priorities, tighter budgets (due to the economic impact) and the potential shortages of skilled Compliance and AML professionals are leading to Regtech Adoption and the Review of the current AML Tech Stack.

But let’s focus for a moment on our 6 Key predictions for 2023.

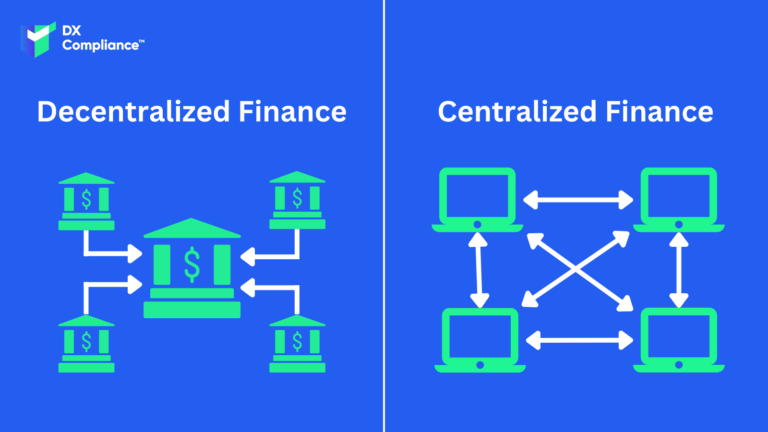

Decentralized Finance is developed less than 1 %. The possibilities are endless and so are the ways to launder money through it. A new wave has called for a decentralized AML approach. In Compliance you don’t have time to play Buzzword bingo.

New Technologies hold in DeFi the promise of democratizing decentralized finance and eroding the advantage of much larger institutions and countries. That of course can have a downside in a dominant and less vulnerable competition and the future concentration of market power among players. Currency dominance can become entrenched with currency issued by prominent companies rivaling national currencies.

To understand the long-term implication and the innovation of Fintech especially the digital currencies we must view it all through the lense of trust.

Crypto isn’t death and no matter if winter or whatever season it has a clear role to play in our world. The adoption of crypto currencies has of course to do with trust. Trust is the biggest concern as we all learned the FTX has shown us how vulnerable things can get.

In his book the Future of Money Esar S. Prasad writes about how the digital revolution is transforming currencies and finance. But what does this mean for the compliance department? Fintech is racing to the future and Regtech needs to keep up with the speed of innovation.

Central banks have been seeking innovative ways of producing money. And while almost all central bankers denied that crypto currencies are a currency (due to its acceptance) it will be interesting to see how monetary policy and the digitalization of money will be impacted by regulation.

It will be seen how central banks and regulators react to these innovations. AML compliance and regulation play a critical role here.

One of the major economic impacts of AML regulations on compliance departments is the need to allocate more resources to compliance efforts. This can include tighter budgets, as businesses may need to devote more funds to compliance training and technology, as well as hiring and retaining staff with the necessary skills and expertise.

In addition, as regulatory expectations continue to evolve and become more stringent, compliance departments may need to implement more sophisticated systems and procedures to ensure compliance. This can also require higher skillsets, as staff may need to be trained in new technologies and techniques to meet these requirements.

Financial inclusion refers to the availability and accessibility of financial services for all individuals and businesses, regardless of their income level or geographic location. Underbanked refers to individuals or businesses that have limited access to traditional financial services, while overbanked refers to those who have access to a wide range of financial services and may have multiple accounts or credit cards.

A glance at the Worldmap reveals that many areas of the world are still non- or underbanked. Financial inclusion is meant for all. Fintech can enable financial inclusion. The question we must ask is: Does fintech have a social impact? Will fintech make the world a better place?

Will Regtech make the world a safer place? If your answer is yes, Fin- & Regtech adoption will rule within the next decade.

The implementation of Regtech in your organization has the potential to either streamline processes and reduce costs or have the opposite effect. Many organizations are still in the process of digital transformation, while others are looking to cut expenses by examining their compliance technology stack.

Upgrading transaction monitoring systems or replacing outdated legacy providers is a key priority for compliance departments in 2023. That’s why at DX, we choose the slogan “Buy less, choose wisely, make it last.”

Criminal and personal liability are the most severe consequences that can significantly impact an individual’s life. Compliance professionals, depending on the jurisdiction they operate in, may now be subject to greater personal liability than in the past. These increased risks highlight the importance of compliance professionals being diligent and proactive in fulfilling their duties and responsibilities. It is essential for compliance professionals to stay up to date on relevant regulations and best practices to minimize the potential for personal liability. The consequences of non-compliance can be severe and far-reaching, not only for the organization but also for the individual compliance professionals involved.

We from DX wish you a fantastic Start in 2023 professionally and personally!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access