20 September 2022, 10:10

Tagline

20 September 2022, 10:10

Tagline

Transaction Monitoring is simply the continuous monitoring of customer transactions for suspicious activity. This includes monitoring transfers, deposits and withdrawals. The aim of transaction monitoring is to act as controls for anti-money laundering and counter finance terrorism. Real-time and ongoing transaction monitoring uses software to increase efficiency.

Transaction monitoring is an important first step for any financial institution’s AML and CTF procedures. The ability to spot a suspicious transaction could potentially prevent large sums of money from being laundered across the globe.

Additionally, having transaction monitoring in place gives regulators and banking partners confidence. It shows that a financial institution takes AML and CTF regulations seriously and is doing all it can to prevent criminal activity. This creates trust between new and/or current partners.

Monitoring transactions is about understanding and mitigating risk. It goes beyond thresholds and hard-coded words and delves much deeper into the associated behavioural activity, both financial and non-financial. Effective transactions monitoring should not look at a single transaction in complete abstract, utilising as much data as possible to paint the fullest picture possible enables both the synthetic mind and the human one to better understand the level of risk and suspicion involved.

The IT architecture required for Real-Time Transaction Monitoring work effectively is becoming more complex. This complex AI and Machine Learning can be difficult to engineer. Read more about the Tech in RegTech here.

Money laundering is a global risk, and every nation state has a different respond to it. Regulations can vary across borders and so it can be a challenge to ensure the transaction monitoring system is aligned to what is needed.

Real-Time is one thing but managing its output is quite another. Organisations have to be able to deal with what real-time checks produce and have the systems and operations in place to deal with it.

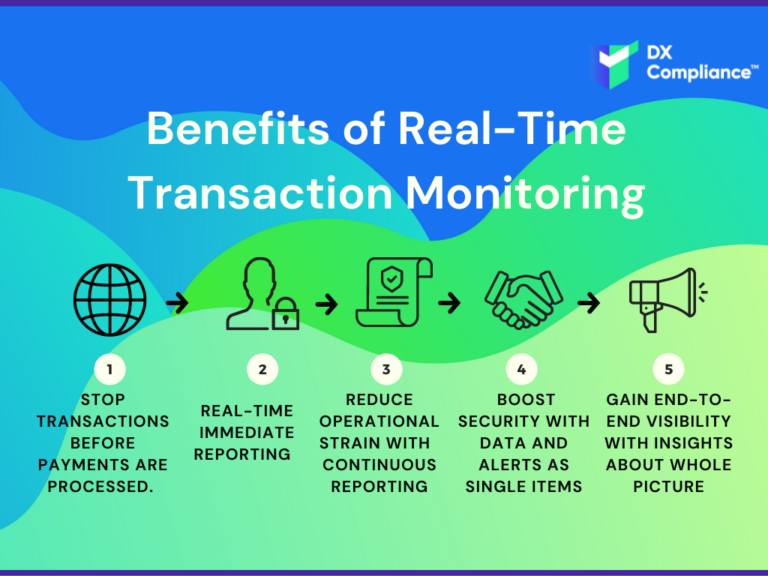

Stop transactions before payments are processed.

Immediate Reporting

Reduce operational strain

Boost security

Gain end-to-end visibility

To combat the elevated levels of false positives seen through traditional AML Transaction Monitoring controls, technology can improve the efficiency for banks and other financial institutions. This type of RegTech applications, such as DX Compliance Solutions, provides a full solution in transaction monitoring. This significantly reduces operation costs with no detriment to the effectiveness through different combined technologies.

Noise Process Learning is a branch of AI that enables computers to understand, interpret and manipulate human language in the same way that a person can. This is used in Transaction Monitoring technology, and it can have great benefit for AML operations. NPL can filter out cases requiring complex investigations and increase conversion rate of alerts into suspicious activity reports.

These combined technologies also allow for SAR submissions to be automated in such a way that it leads to more accurate and efficient working. Application Programme Integration is used as it allows for different systems to communicate through AI and so this is beneficial within ongoing AML monitoring as well.

Regulators around the world learn the benefits and challenges of AI and ML. Regulators need to understand what the Role of AI in Transactions Monitoring is!

As Regulators move ad different speed. A global picture shows that Explainable AI is on the rise. The reason behind this trend is to put the Control of Frontier Technologies in the hands of humans and not the machines. Compliance Professionals and regulators become increasingly educated about the potential and the challenges of AI and other frontier tech.

AI will never take over as this is not the promise of AI.

Many organizations have already a Transactions Monitoring System in place. Most of these organizations never have upgraded their solution which of course has led to fines. This can be seen in the latest example of the Danske Bank which was fined (€1,820,000) by the Central Bank of Ireland for monitoring failures.

Historic Transaction Monitoring Systems have a very limited suite of scenarios with parameters that though moveable, are neither specific to a single entity or sector. These traditional rule-based systems have been made 20 years ago and of course they cant cope with today’s world.

Therefore, in simple terms the rules were applied the same across all clients. This is neither risk based nor effective at mitigating financial crime. Rules need to be flexible and easy to integrate.

As Financial crime trends and typologies vary across client sectors, products and geographies as well as the underlying means to commit crime varies.

Traditional Transaction Monitoring systems have been also ‘retail’ focused, and are made up of a binary set of scenarios and due to the amount of false positives are neither cost effective or efficient.

Therefore, organizations need to upgrade their existing transactions monitoring to a modern software platform or replace it with a Vendor that suits their needs.

Modern software vendors are using the latest technology with the enhancement of AI/Machine Learning which improves the hits and results in efficiency and effectivity.

Do your homework and invest upfront time and effort to evaluate which transaction Monitoring Solution you need and want. Our Buyers Guide that you can download in our Whitepaper sections can help you here.

If you want to build your own system, good for you. However, keep in mind, there are people around that can support you in a much smarter & faster way. If you have already a self-built solution make sure that your current solution is up to date and there is continuous improvement. Otherwise, you should evaluate state of the art Transactions Monitoring Solutions to ensure you are not caught out.

The benefits of a Specialized Vendor in AML Transactions Monitoring who provide you with AML Software, both in terms of screening and on-going monitoring for high-risk and suspicious activity could prove priceless!

If you buy a solution form a Tech provider like DX Compliance, you are getting a state of the art Transactions Monitoring platform that of course is updated and improved regularly. Building your own solution is not only (more) expensive it is also a risk for the organization as tech solutions needs updates, maintenance and continues improvements. The true cost of a self-build solution which is around 1 Mio $ + makes it extremely expensive to build a own solution from scratch.

Financial institutions have been fined for having a self-built solution that never has been updated. As recently highlighted by the Central Bank of Ireland why fined a Nordic Bank with more than 1.8 Mio Euros.

The detailed report highlighted that the root cause of this failure was historic data filters that were applied within the Bank’s automated transaction monitoring system, first implemented in 2005 and rolled out to the Irish branch in 2006. The bank failed to ensure that its automated transaction monitoring system monitored the transactions of certain categories of customer for money laundering and terrorist financing risk at its Irish branch for a period of almost nine years.

Lesson Learned! Keep it simple and don’ t put your organization at risk.

DX Compliance is a software-as-a-service (SaaS) and provides a full Real-Time Transaction Monitoring Solution through different combined technologies. DX aims to help achieve regulatory AML compliance by empowering compliance people in AML. We use technology to help complete their workload with greater speed, reduced costs and allowing the people to focus on the tasks at hand and let us take care of the technological solution. For more information, reach out to us here.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access