20 October 2022, 17:17

Tagline

20 October 2022, 17:17

Tagline

Financial fraud and compliance are constantly evolving. Year by year, the criminals are becoming more sophisticated. Therefore, financial institutions must also make the most of new technologies as part of the digital transformation of AML to stay one step ahead of the criminals.

But traditional anti-money laundering (AML) systems are no longer sufficient to combat financial crime. Many detection systems produce inaccurate results due to outdated rules or thresholds – there are too many false positives and true negatives.

That’s why many financial institutions are embracing AI-powered technologies. So let’s take a look at the value and use of AI in transaction monitoring.

The transaction monitoring system should be able to detect patterns of activity that appear unusual and potentially suspicious to customers, as well as fundamental unusual behavior. For this, data is just used in an intelligent way and AI is implemented.

A recent case in the Neatherlands highlits how the industry is coping with the change: Recently the challenger bank bunq won its appeal against the Dutch Central Bank (DNB), in a landmark case concerning the use of modern technology to effectively combat money laundering.

For years, bunq has argued for a more effective approach for anti-money laundering. Engineers had built risk-based methods that incorporated advanced technologies based on Artificial Intelligence, to combat fraud smarter, quicker and more effectively.Bunq shared their findings with DNB, to no avail. The Dutch regulater (DNB) Instead on their own, antiquated approach and demanded to follow suit.Knowing the safety of users Bunq sued the Regulator DNB.

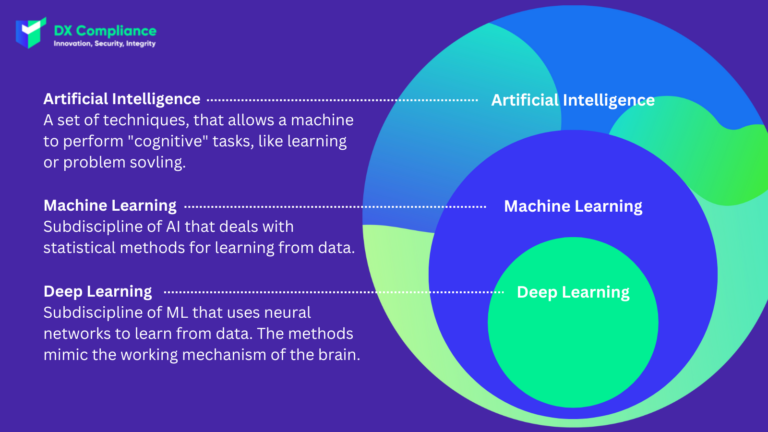

To put it simply, Artificial Intelligence (AI) refers to machines that can learn. Your computer can’t think like you, but it can analyze a lot of data quickly and use algorithms in ways that humans can’t. This can also be used for AML to make compliance more effective and less time-consuming.

Artificial intelligence is not a stand-alone tool, but rather a feature of automated AML screening and transaction monitoring. When applied properly, it is extremely powerful and can automate AML processes, reducing inefficiencies and human error.

As part of artificial intelligence, machine learning refers to software programs that use data and algorithms to identify patterns in human transactions. Over time, the program can detect changes in customer behavior, making it easy to identify suspicious activity.

These programs monitor ongoing transactions and learn to predict financial behavior. If a customer’s previously unremarkable financial activity changes, the software will alert you to these suspicious transactions. This can include unusually high deposits and withdrawals, a change in the frequency of transactions, and more.

Machine learning reduces your losses from money laundering by alerting you to potential problems that you might not otherwise detect. It also helps reduce false positives by helping to optimize your AML rules over time.

The Financial Action Task Force (FATF) addresses AI tools for AML compliance in the 2021 publication Opportunities and Challenges of New Technologies for Combating Money Laundering and Terrorist Financing (AML/CFT). It describes AI as the use “advanced computational techniques” to “perform tasks that typically require human intelligence, such as recognizing patterns, making predictions, recommendations, or decisions.”

It explores the ways AI can help companies analyze and respond to criminal threats by automating the compliance process, making it faster and more accurate, and helping companies categorize and organize relevant risk data. The FATF puts into focus that artificial intelligence and machine learning, has great potential for combating money laundering and terrorist financing. This is because it allows computer systems to be trained to “learn from data” without the need for extensive human intervention.

Given this potential, the FATF has suggested numerous ways in which AI and machine learning can be implemented into an AML/FT solution and used to facilitate critical compliance tasks, such as:

Transaction monitoring is the continuous monitoring of customer transactions for suspicious activity. This includes the monitoring of transfers, deposits, and withdrawals.

Artificial intelligence can detect money laundering in a number of ways, using specialized algorithms. Essentially, these algorithms analyze huge data sets and sound the alarm when something potentially risky is found. This might include unusual transactions or account activity that could be considered suspicious.

There are many different approaches and techniques on how AI in AML works. We have compiled a selection below to bring you closer to how transaction monitoring systems work through AI.

AI can analyze customer transaction behavior to make predictions about the customer in the future. Thus, this results in how the customer would behave in the future (for example, typical deposits and withdrawals). Thus, the “normal” activity is known. The AI transaction monitoring system then responds to changes in behavior, no matter how subtle, and can highlight suspicious changes in behavior that might be missed by traditional AML systems.

AI and machine learning systems help identify anomalies and outliers. Data analysis reveals not only “normal”/unusual behavior from individual customers, but also from the general public. This allows potential high-risk customers to be identified.

As we explain in the Transaction Monitoring Rules article, thresholds are often used to detect suspicious behavior. Examples would be:

AI can be used here to intuitively set thresholds for monitoring AML transactions based on an analysis of risk data. When a customer approaches or exceeds a set threshold, machine learning tools can decide whether to trigger an AML alert based on information about the customer’s profile or financial situation.

The goal of using AI in AML is not to replace humans. On average, 1% of all transactions are suspicious, but depending on the organization, there are companies that classify up to 15% of their transactions as suspicious. This results in extra work for compliance staff.

AI reduces these false positives: AI reduces the number of false positives, which would reduce the cost of compliance without compromising regulatory obligations.

Another important benefit of AI in AML is that it automates the search for potential money laundering risks: Machines, rather than humans, continuously monitor and effortlessly detect patterns as they occur. In the face of massive amounts of data, timely detection of complex behavioral patterns is a task that is nearly impossible for humans to accomplish effectively.

This automation of tedious, repetitive and nearly impossible tasks allows compliance officers to focus on what their expertise is focused on.

With a better foundation of prior work, AI transaction monitoring systems can improve decision making. Does an activity have to be submitted to the competent authority as a SAR or is there no risk after all? The enormous and important preliminary work here is done by AI in AML, which the compliance officers then still have to evaluate.

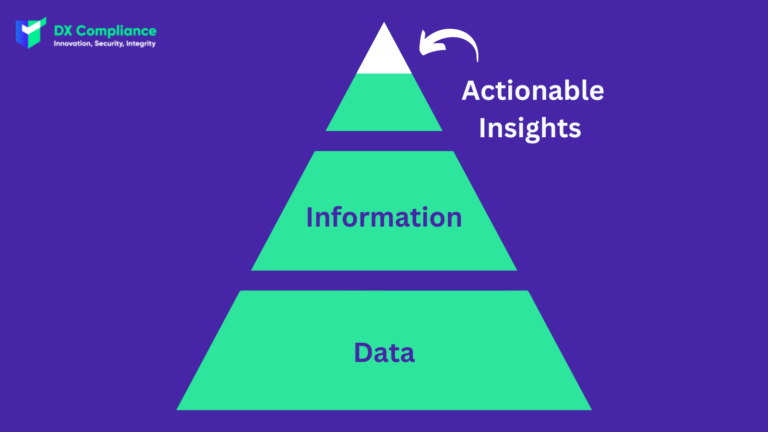

Actionable insights are conclusions drawn from data that can be turned directly into an action or a response.

Which is, of course, one of the important benefits of AI in AML: Your org can keep up with sophisticated criminals with the help of AI. It can support compliance with increasingly stringent regulations and help protect against a crisis associated with or even facilitating financial crime. Without AI in AML, you simply won’t be able to protect yourself at that level.

When implementing AI in AML, be prepared that it will initially take time and effort. AI is as much a top-down cultural commitment as it is a financial investment. It’s important to put the right governance and processes in place and clearly define the intended outcomes before embarking on a machine learning project.

For this reason, it makes sense to sit down with a tech provider. Rely on the experience of professionals to take you through the benefits of artificial intelligence as well and efficiently as possible.

To get started, your new system must first learn from your organization’s historical data. The task of preparing data should therefore not be underestimated, especially if your data is poorly organized – which is unfortunately the case for many organizations.

But in addition to the internal sources you already have (e.g., account activity and transactions), you also need to integrate data from external sources. These include sanctions lists and credit ratings, for example. But don’t worry – access to these (hundreds of) databases is supplied by your Tech Provider like DX Compliance.

With such a shift to AI in AML, people’s skills also need to evolve. This is because machine learning, while changing the nature of work performed by humans, does not make humans obsolete.

First, the responsible employees need to learn how the transaction monitoring tool works. They must be able to operate it, but also understand the content and messages. This is the only way that humans can subsequently learn to analyze the data. What can be derived from the information? This in turn is important in order to be able to make decisions.

DX Compliance is a software-as-a-service (SaaS) and provides a full Real-Time Transaction Monitoring Solution through different combined technologies.

DX aims to help achieve regulatory AML compliance by empowering compliance people in AML. We use technology to help complete their workload with greater speed, reduced costs and allowing the people to focus on the tasks at hand and let us take care of the technological solution. For more information, reach out to us here.

Curious? Please contact our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access