18 October 2022, 13:59

Tagline

18 October 2022, 13:59

Tagline

Transaction monitoring is the continuous monitoring of customer transactions for suspicious activity. This includes the monitoring of transfers, deposits, and withdrawals.

Transaction monitoring is thus a part of the anti-money laundering and counter-terrorist financing controls to be carried out.

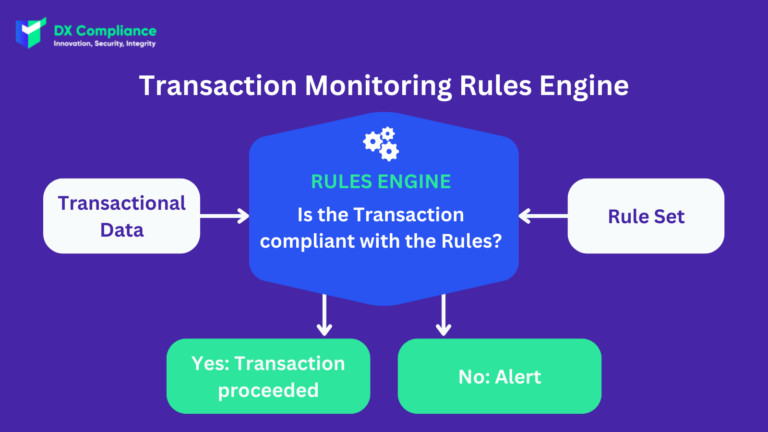

Rules play a major role in transaction monitoring. They can be used to determine whether a transaction should be proceeded with or flagged for more in-depth review by an AML analyst and other compliance professionals.

In general, rule-based monitoring compares customer activity against fixed thresholds or patterns to determine if it is unusual.

The basic logic is: If condition A or B applies to this transaction/account, then issue an alert to the compliance officer for review.

This rule refers to high-risk jurisdictions that are countries with significant strategic deficiencies in their anti-money laundering and counter-terrorist financing regulations/measures.

Thus, a AML rules could be:

This rule identifies parties with unusually high payment transaction volumes. This rule is appropriate for a peer-to-peer payment network where funds may be withdrawn to an external account.

This rule describes a significant increase in the value of outgoing transactions compared to the last average. It looks for recently operating parties whose transaction value is significantly higher than the 7-day moving average.

This rule defines actions that deviate from the person’s standard behavior. This could indicate an account takeover or an externally influenced transaction.

Examples are:

This rule triggers an alert when a customer changes their personal information just before a large transaction. This could indicate an account takeover or possible “layering” activity to disguise the path of funds.

This rule refers to a high volume of transactions from new users. Merchants find that a high percentage of their activity comes from new accounts, which is a potential warning sign of money laundering or traditional fraud.

Thus, AML rules could be:

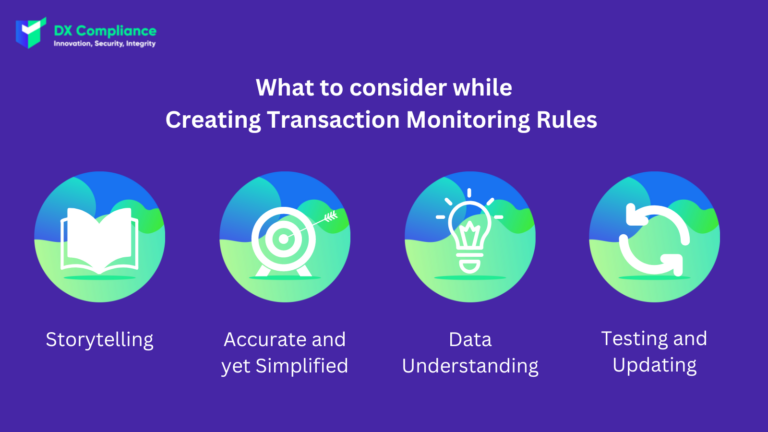

Rules may sound relatively simple, but there is a lot to consider. We have compiled the most important aspects below.

Stories are a great technique for writing rules. That’s because they help them understand, in simple language, exactly the kind of behavior you’re looking for.

Thus, try to think in terms of human behavior rather than convoluted conditions.

The rules should generate as few false positive warnings as possible. In other words, identify as few transactions as possible as warnings that are not actually warnings. For this, it is important that the rules are precisely defined.

Here is a simple example: If every transaction from an account in a high-risk country is flagged because there might be a money laundering threat behind it, you would get an unimaginably long list of cases. All transactions from the countries. But if you add a second condition, like the threshold amount of $30,000, then the number decreases significantly. The warnings will be minimized to the real risks. After all, a transaction with, say, $5 is most likely not going to carry any risks….

On the other hand, keep the rule simple as well. It’s better to have two separate rules than one rule that covers an overly complex use case.

It is important to know what data you have available. For example, you cannot implement a rule for high-risk countries if you do not have the countries in your data.

Rules that have been newly created should first be tested in the test instance. Only then should they be used in the production instance. In other words, only after you have determined that they work during testing. This results in less risk that you are responsible for wrong results due to incorrectly defined rules.

Care must be taken to ensure that the rules are always up to date. The rules may need to be updated because there have been changes in regulations or in the typical behavior in money laundering.

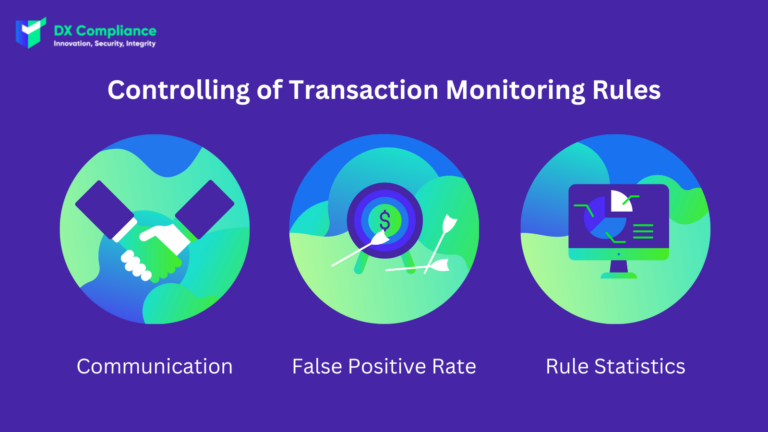

It is important to note: The entire compliance department should be aware of the newly added rules.

A combination of qualitative and quantitative approaches is required to control the rules for effectiveness and efficiency.

DX Compliance is a software-as-a-service (SaaS) and provides a full Real-Time Transaction Monitoring Solution through different combined technologies. DX aims to help achieve regulatory AML compliance by empowering compliance people in AML. We use technology to help complete their workload with greater speed, reduced costs and allowing the people to focus on the tasks at hand and let us take care of the technological solution. For more information, reach out to us here.

DX Compliance Transaction Monitoring Platform provides a no-code rules engine unlimited scenarios that of course can be fully customized and configured and changed anytime. This is so powerful because AML & Compliance professionals can directly change and optimize Transaction Monitoring Rules and typologies anytime. It allows you to create edit or delete rules in a matter of minutes.

Creating a rule is very easy due to the user-friendly interface. The rule can be quickly named and created in the provided field with operators as help.

For the rules you can then determine how high risk is associated with it. Are people or companies that fall under it low or high risk? You can decide that for yourself.In addition, these rules can be created for certain groups such as Generic, swift, trade, SEPA.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access