26 September 2022, 12:50

Tagline

26 September 2022, 12:50

Tagline

Technology transforms the way we live and work. In many fields, it results in increased efficiencies and cost savings. Tech can help reducing human error and improving the world into a better and saver future.

This is also relevant for the AML Compliance industry. The use of new technologies can help financial institutions and supervisors assess money laundering and terrorist financing risks more accurately, timely, and comprehensively. They can increase the speed, quality, and efficiency of money laundering countermeasures.

New digital AML technologies referring to anti-money laundering (AML) and counter-terrorist financing (CFT) include:

Today we have a new era of financial crime, dominated by complex interconnections and undefined geographies.

This results in a challenging environment for financial institutions. Because they must comply with global legal and regulatory frameworks, anti-money laundering guidelines, and sanctions.

In the area of digital currencies e.g., international bodies such as the World Bank, the International Monetary Fund, the Financial Action Task Force, the European Central Bank, and the Committee on Payments and Market Infrastructures have defined guidelines to mitigate the risks associated with digital currency transactions. And these risks can be significant.

In order to keep up with the enormous development of technological innovation, financial institutions need to adapt their risk-based approach. This is the only way to take into account the impact of new technologies and new business methods on money laundering and terrorist financing.

Thus, Tech is the future because it is the only possible way to make Compliance and Risk Professionals successful in protection their organization. It’s aim is to support and not replace humans.

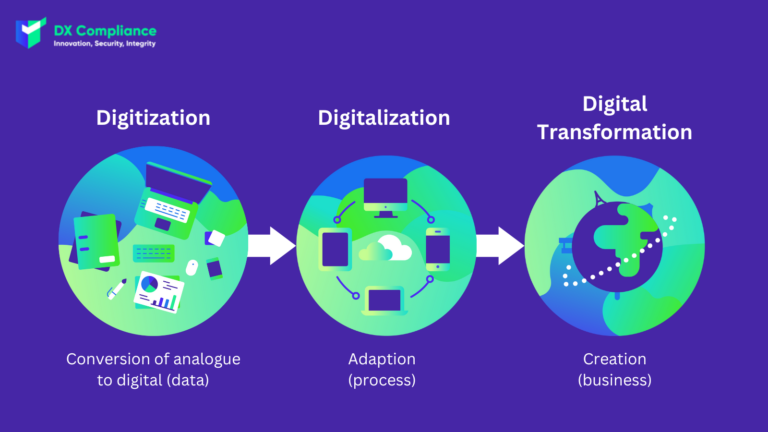

Digitization is about converting analogue data from a paper or text/image-based form into a digital form that can be easily read, processed, reproduced and transmitted by computers.

In financial intelligence, digitization can refer to turning suspicious transaction reports (STRs), suspicious activity reports (SARs), cash threshold/transaction reports (CTRs), and other images and information into a digital format.

Digitalization refers to enabling or improving processes by leveraging digital technologies and digitized data. Therefore, digitalization presumes digitization. Examples of this could be automation, which helps streamline repetitive workflows and minimizes processing time. One example is automated submissions of STRs.

Digital transformation is more holistic, involving the whole organisation and changing organisational culture and relationships to users, as well as business processes.

Digital Transformation refers to a process of adoption of digital tech tools and methods by an organisation. Typically those that have either not been including the digital factor as part of their core activities or have not kept up with the pace of change in digital technologies.

At DX Compliance we see 4 main advantages of digital transformation of AML:

Speed, flexibility, performance and better governance are results of digital AML, leading to a significant increase in efficiency. Delivering faster and more cost-effective tools to stakeholders is possible. In addition, what is of course a relevant aspect here, is the real time monitoring.

New technologies enable information stored in internal systems to be more accurate. Here, the aspect of timeliness and the ability to continuously analyze and update data without the need for human intervention is relevant.

The digital transformation of AML makes it possible to improve AML/CFT capabilities and free up personnel for more important tasks, such as analyzing complex money laundering and terrorist financing cases.

Furthermore, data management, including the ability to collect, analyze, and use information in a useful but cost-effective manner results in a very cost-effective manner.

Better identify and understand the risks associated to the different sectors individual entities. Stay compliant and protect your organisation against sanctions.

At DX we see the opportunity in multiple ways:

The digital transformation of AML Compliance has many advantages, such as the efficiency already described. This also results in increased performance. On the one hand, there is more possible – more analysis, especially more difficult analyses, because they are calculated by the system.

On the other hand, the error rate is lower. The digital AML systems are more accurate than ever. Ensuring you’re seeing more of what you need to, and less of what you don’t

To ensure global compliance, many data bases are used. For the PEP Screening, we at DXCompliance screen over 400 of lists around the globe, including:

Digital AML provides an overview which makes it easier to understand and manage risks. Especially visualizations help.

In June 2022, the FATF Conference on Digital Transformation in AML was hosted in Berlin. More than 100 experts in Anti-financial crime and technology gathered to discuss the potential benefits and challenges of digital transformation in the fight against money laundering and terrorist financing.

The conference marked the completion of four projects under the FATF’s German Presidency, which has extensively considered the potential impact of new technologies on anti-money laundering (AML) and counter-terrorist financing systems. The FATF President T. Raja Kumar committed to continuing engagement and work in this area.

One of the keynote speaker, the Deputy Commissioner James Dipple-Johnstone of the UK Information Commissioner Office highlighted the importance of AML initiatives taking into account privacy concerns.

The role of big data and advanced analytics in transforming the capabilities of operational agencies in detecting and investigating money laundering (ML) and terrorist financing (TF) and understanding ML/TF risks. Technological advances in recent years allow financial institutions – no matter of which size – to analyse large amounts of structured and unstructured data more efficiently and identify patterns and trends more effectively.

This helps financial institutions to better understand, assess and mitigate money laundering and terrorist financing risks. It can of course reduce the number of false positives, enabling the private sector to comply in a timelier and less burdensome manner. Which will lead to prevent criminals from exploiting the information gaps, as they engage with multiple domestic and international FIs, each having a limited and partial view of transactions.

However, it may also infringe on the protection of individual and fundamental rights. Therefore, it is imperative that any exchange of information respects national and international legal frameworks for data protection and privacy this is why Vendors need to apply not only a GDPR friendly approach it needs to be also a GDPR future proof approach as GDPR is only developed 1 % worldwide.

For further FATF resources we recommend to read the FATF’s reports for Digital Transformation of AML/CFT.

DX Compliance provides a Real-Time Transaction Monitoring Solution helping financial institutions to identify suspicious behaviour and to protect their organization.

Our Transactions Monitoring Platform helps financial institutions to monitor their customer transactions and to report the suspicious transactions directly to the FIU.

Curious to learn more? No matter if you are looking into upgrading our replacing your current AML Transactions Monitoring, feel free to get in touch with our experts.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access