27 January 2023, 10:52

Tagline

27 January 2023, 10:52

Tagline

GoAML is a web-based system for tracking and reporting suspicious transactions and other activities related to anti-money laundering (AML). It is used by financial institutions and other organizations to comply with AML regulations and to detect and prevent money laundering and other financial crimes.

The system allows users to submit suspicious transaction reports (STRs) and other information to the relevant authorities, and to track the status of their reports and other communications with the authorities.

GoAML is a product of the Financial Action Task Force (FATF), an inter-governmental organization that develops and promotes policies to combat money laundering and terrorist financing. The organization was founded in 1989, and is based in Paris, France.

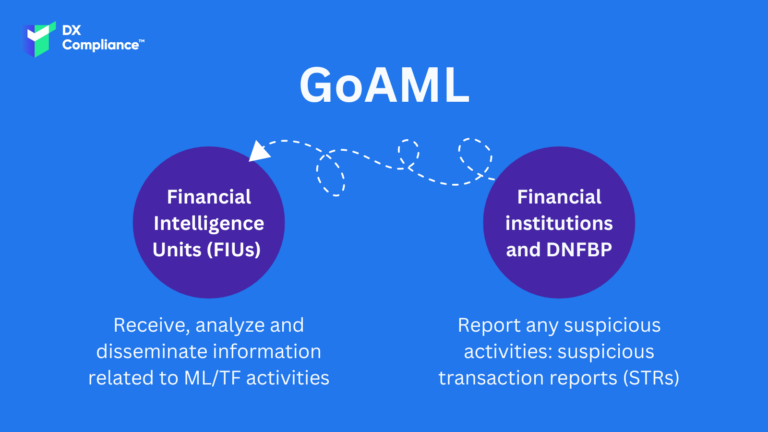

On the one hand, Financial Intelligence Units (FIUs) use GoAML as a tool to receive, analyze and disseminate information related to money laundering and terrorist financing activities. They typically act as a central point for the collection and analysis of this information.

On the other hand, banks, money service businesses, casinos, real estate agents, lawyers, accountants and other professions and sectors that have a higher risk of money laundering and terrorist financing activities are required to use GoAML to report any suspicious activities. These entities need to comply with anti-money laundering (AML) regulations and use goAML to submit suspicious transaction reports (STRs) and other information to the relevant authorities. They also use GoAML to track the status of their reports and other communications with the authorities.

GoAML is important because it helps countries comply with international standards for anti-money laundering (AML) and countering the financing of terrorism (CFT). By using it, countries can improve their ability to detect and prevent money laundering and other financial crimes by submitting suspicious transaction reports (STRs) and other information related to money laundering and terrorist financing activities to the relevant authorities, and to track the status of their reports and other communications with the authorities.

GoAML is also important as it helps to improve international cooperation in the fight against money laundering and terrorist financing. The system allows countries to share information and intelligence with one another, which can help to identify cross-border activities and to track the movement of illicit funds. It also enables countries to report and track suspicious transactions in real-time, which helps to improve the speed and efficiency of investigations and law enforcement actions.

Today, the following member states are users of GoAML:

DX Compliance is an AML Compliance firm helping our clients identify, prevent and report financial crime. DX Compliance help Banks, FinTech’s and Payments Providers to continually monitor their risk and detect the threat of money laundering to ensure compliance and reduce fines.

One of the solutions within our transaction monitoring system is the automated reporting of suspicious activity. The automated SAR feature automatically generates and submits the necessary documentation and forms required for the GoAML suspicious activity reporting, eliminating the need for manual data entry and reducing the risk of errors.

Curious? Please contact our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access