29 November 2022, 13:19

Tagline

29 November 2022, 13:19

Tagline

There is no single definition for precious metals and gemstones (PMS). However, their forms are generally recognized as diamonds, emeralds, sapphires and rubies, and precious metals consisting of gold, silver, platinum and platinum-like metals. In addition, in the United Arab Emirates, pearls and all items whose monetary value is at least 50% of the PMS are classified as a type of precious stone.

Dealers in Precious Metals and Stones (DPMS) fall under the Financial Action Task Force’s (FATF) international standards related to the Recommendation on Designated Non-Financial Businesses and Professions (DNFBP). In the UAE, DPMS represent the largest DNFBP sector.

DPMS are defined as…

any natural or legal person (or legal arrangement), or their employee or representative, who engages, as a regular component of their business activities, in the production and/or trade of precious metals or precious stones, whether in raw, cut, polished, or elaborated (mounted or fashioned) form.

Therefore, the ML/TF risk of misuse of DPMS should be well understood and monitored by DPMS conducting proper due diligence and risk assessment, keeping records, and reporting suspicious transactions.

Dealers in precious metals and stones have characteristics that distinguish them from other DNFBPs and make them more vulnerable to abuse. We have listed the relevant aspects below:

DPMS companies are used as a front to launder money using trade based money laundering methods such as false invoices, bogus shipments, and fictitious sales agreements/contracts. It is also exploited to transfer/move foreign illicit proceeds through the country’s financial system, disguised as trade-related activities.

In addition, there is the use of multiple DPMS entities as networks to facilitate the layering of funds. This is done by sending/receiving large remittances or wire transfers to/from multiple local or international counterparties and then circulating the funds between domestic entities without any apparent justification for such proceeds or movements.

DPMS entities direct individuals (e.g., employees, agents, or outside parties) to engage in foreign exchange transactions on behalf of the entity without including the DPMS entity’s name in those transactions. Individuals then indicate that the money is coming from savings or salaries, for example, and will be used for travel or family maintenance.

Another approach is to engage in gold smuggling from conflict and high-risk areas or in the illegal transport of gold through other high-risk countries. From there, the gold enters the country and is resold to other local DPMS facilities or processed and re-exported to Western European countries. This practice is also related to cash smuggling.

The UAE Financial Intelligence Unit has compiled risk indicators that may be directly or indirectly relevant to the misuse of dealers in precious metals and stones. Following these, we have listed example indicators below that could potentially point to the risk of abuse of the PMS sector or the establishment of DPMS entities for ML/TF:

Precious metals were the eighth largest traded product in the world in 2020, with an estimated value of $699 billion and a growth rate of 7.28%. This meant that trade in precious metals accounted for 4.17% of total global trade. The UAE was among the world’s leading exporters and importers of precious metals in the same year. There is an estimated value around between 40 and 55 USD.

During the period from June 2021 to June 2022, the UAEFIU received more than 300,000 DPMSRs. The main currencies used in the purchase or sale of items categorized under dealers in precious metals and stones were:

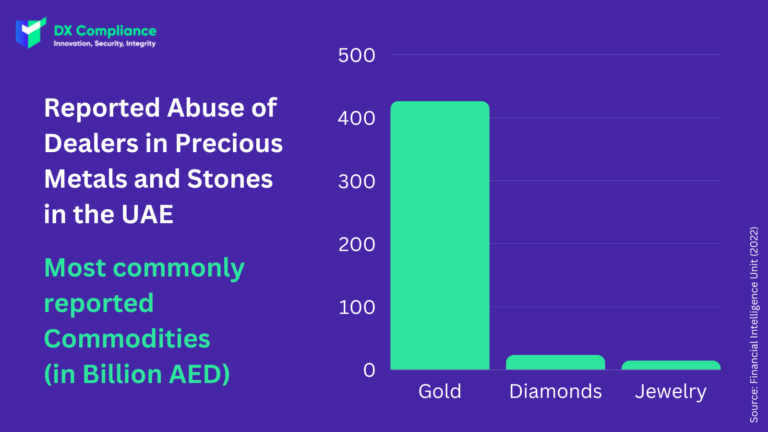

The commodities categorized under DPMS are diamonds, precious stones, gold, jewelry, platinum, and silver. The most commonly reported are listed below:

Due to the dangers explained so far, it is very important as dealers in precious metals and stones to ensure that no business relationship is entered into with potential risk partners or customers. Therefore, these partners and customers must be vetted BEFORE a business transaction is initiated or entered into. This includes conduct proper due diligence and KYC. Several activities are part of this, which we have compiled below.

PEP (Politically exposed Person) is not in all jurisdictions defined in the same way. But in general, Politically exposed Persons (PEPs) are persons who hold or have held an important public function. This function may, for example, give them influence over the use of taxpayer funds or the awarding of contracts by state-owned enterprises. As such, they are considered by the Financial Action Task Force to be a category of individuals more vulnerable to bribery, corruption, and money laundering than most.

Within the sanction screening, you can check for targeted financial sanctions (TFS). Individual countries and multinational organizations (e.g., the EU and the United Nations) impose sanctions to pressure other countries or organizations to change their behavior. Sanctions can be directed against individuals, specific companies, or entire nations.

There are 2 main types of financial sanctions: Asset freezing and the prohibition to offer funds and services.

The aim of a client risk assessments is to identify and assess the money laundering (ML) and/or terror financial (TF) risks identified at individual client level.

Therefore, the Risk Based Approach is important to implement in your organization. As a core principle of AML compliance the so called risk-based approach (RBA) refers to adjusting the level and type of compliance work done (frequency, intensity and/or amount), to the risks present.

DX Compliance is an AML and Compliance firm helping our clients identify, prevent and report financial crime. DX Compliance help Banks, FinTech’s and Payments Providers to continually monitor their risk and detect the threat of money laundering to ensure compliance and reduce fines.

CheckAML is the most efficient and cost-effective way of carrying out money laundering checks. We offer the only instant AML solution with full PEP & sanctions screening, ongoing monitoring and customer risk assessment worldwide. This helps to ensure Client Due Diligence for legal practices.

Our data and coverage is global, real-time and reliable, all your checks are automatically saved, for audits and regulatory visits. So everything you need we’ve got you covered.

Start your journey today and use CheckAML to screen your clients against global databases on an ongoing basis. To setup your account it takes less than 5 minutes. To learn more we also recommend to speak to our regional Sales Team and ask for a Demo.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access