27 October 2022, 10:44

Tagline

27 October 2022, 10:44

Tagline

Know Your Customer (KYC) is required by regulators as an integral part of banks’ AML processes. Since then, financial institutions have put in place technical systems and invested significant effort in large financial crime departments to classify their customers and create risk profiles. In this regard, KYC is a key element in the customer onboarding process and risk-based transaction monitoring.

Financial institutions know their customers better than ever before. But, do they also know how customers behave? Of course, KYC helps with risk-based due diligence and allows a closer look at more critical customers and their payments. But should that be augmented by a closer look at transactions.

Especially in light of the increasing prevalence of cryptocurrencies, being able to examine crypto transactions for evidence of financial crime. The focus is not on the individual, but on the entity or transaction, its historical associations, and the linkages to that transaction.

This is what the concept KYT stands for: Know Your Transaction.

Know Your Transaction (KYT) is a term used in the financial sector. KYT is one of the components of anti-money laundering measures. It involves critical analysis to detect and identify suspicious fraudulent transactions by consumers based on their accounts and profiles.

The goal of KYT (Know Your Transactions) is to identify potentially risky transactions and the unusual behavior underlying them in order to detect money laundering, fraud, or corruption.

Information about transactions made by a financial company is collected first. Examples of such data include contracts, customs documents, or invoices for purchases. In addition, IP addresses in online banking or the use of geospatial data could provide information about the origin of the payment.

It is then assessed whether the transactions are legal and not related to financial crime. In other words, the risk of the transactions carried out by their customers is assessed.

The results of the efficient KYT system serve as reliable evidence and help institutions protect themselves from fraud and fines.

Know Your Customer (KYC) is an approach to verifying customers and knowing their risk and financial profiles. Effective KYC involves knowing a customer’s identity, their financial activities and the risk they pose.

The steps of KYC include:

The point is to make sure that customers are not violating any restrictions.

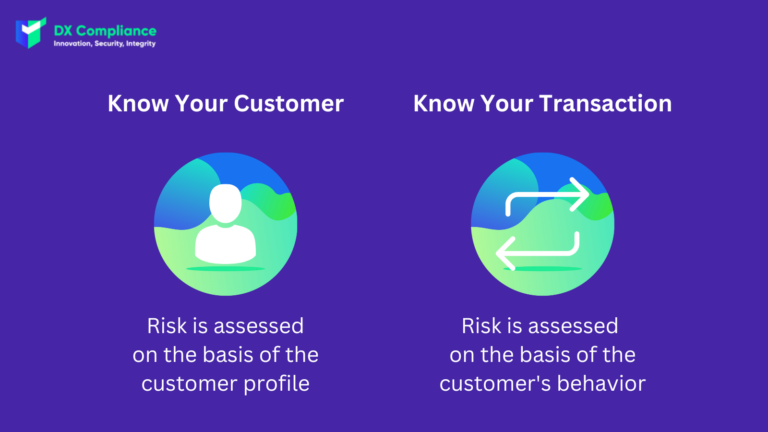

The core difference between KYC and KYT is that KYC focuses on the customer as an entity (is it a PEP or have there been criminal incidents) and KYT focuses on the behavior i.e. the transactions of the customer when assessing risk.

However, KYC is not enough to give companies a better knowledge of their customers and their transactions. This is where KYT comes in, allowing companies to monitor transactions and gain additional facts and insights about customer transactions.

Today, banks and financial institutions are increasingly involved with digital assets. Whether they act directly as service providers or indirectly as digital asset account managers, they will need to start understanding more about transactions and money flows on the blockchain either way, and supplement KYC due diligence with KYT compliance procedures. The increasing prevalence of cryptocurrencies has further expanded the scope of KYT by allowing institutions to disaggregate and structure crypto transactions for AML monitoring and risk mitigation.

With cryptocurrencies and blockchain technology, the focus is not on the individual, but on the entity or transaction, its historical associations, and the linkages to that transaction. It is not possible to monitor a customer using the blockchain, but it is possible to monitor the movement of funds through an address to determine the authenticity and legitimacy of that transaction.

KYT’s transaction monitoring program uncovers the true business activities of customers; it provides data-driven conclusions by examining transactions in real time. Based on patterns and characteristics derived from raw transaction data and associated with the nature of the transaction, red flag indicators are derived in terms of location, payment speed, timing, originating bank, etc.

The world of identities is in constant flux and institutions need to keep pace with the continuous review of their customer base. That’s why KYC is not enough to prevent financial fraud. Organizations must continue to understand that Know Your Customer (KYC) is one of the most important AML procedures because it is required for the onboarding process. KYC and screening for PEP, sanctions, and unwanted media provide a basic profile of customers coming on board. Yet KYC is a static approach that lacks advanced screening to monitor customer transactions and assess their risks.

The solution is KYC AND KYT.

In addition to KYC measures, KYT involves breaking down granular records of customer transactions based on their risk profiles and identifying bad or fraudulent transactions they may be engaging in.

Basically, it can be said that every industry dealing with mass transaction processing today needs Know Your Transaction (KYT). In this context, KYT programs are tailored to the requirements of the industry. For example, they look at the type of transaction (cash or card payments, SWIFT transactions, wire transfers, third-party payment processing, etc.).

However, the term KYT – as already alluded to – is primarily in focus in the crypro sector. This is because in blockchain and cryptocurrencies, the focus is on the transaction rather than the identity. Here, authenticity is attributed to transaction history linked to patterns, not to blockchain customers.

KYT has become more prominent among banks and financial institutions that service digital assets or blockchain customers. With the introduction and adoption of the FATF Travel Rule, it is now inevitable to complement KYC due diligence with KYT efforts to complete compliance measures related to crypto exchanges and VASPs.

Transaction laundering can easily be associated with money laundering, with the main difference being that transaction laundering is conducted online.

Transaction laundering uses a superficially legitimate-looking website with visibly clean advertising. However, illegal/prohibited products or services are being sold in the background through a disguised website.

The banks and credit card networks are deceived, assuming they are processing payments for a legitimate website.

KYT transaction monitoring has tremendous potential to uncover transaction laundering. It investigates sinister merchant activities and their behavioral patterns to uncover prohibited e-commerce websites.

As the name suggests, the main input data for transaction monitoring are: transactions. These are used to monitor customer behavior in relation to money laundering and other financial crimes.

While the quality of customer data has improved over the years in line with the spread of the Know Your Customer (KYC) concept, transaction data is often inadequate and non-standardized. Although the structure and format of transaction data is improving, the content is often inadequate. It is often insufficient to understand what the transaction is about. The “true” purpose and origin of payments is often difficult to discern, and transaction alerts are often false positives.

Another more specific challenge from the implementation of KYT is the identification of all participants in the payment transaction. Non-customers of banks do not have a unique identifier. Identification via account number or IBAN may be possible, but not always.

This is complicated by the fact that transaction participants have freedom in, for example, defining names via the letter option. This often results in transactions to the same beneficiary not being recognized as such due to different spellings.

KYT Know Your Transaction monitoring programs are based on international AML standards. These include payment reporting regulations and red flag indicators as established by the Financial Action Task Force (FATF) and other international organizations. The latest FATF regulation includes continuous tracking of transactions involving various cryptocurrencies for virtual assets service providers (VASPs).

Failure to comply with international standards is mainly punishable by fines and imprisonment as set forth in national money laundering and financial crime laws.

DX Compliance is a software-as-a-service (SaaS) and provides a full Real-Time Transaction Monitoring Solution through different combined technologies.

DX aims to help achieve regulatory AML compliance by empowering compliance people in AML. We use technology to help complete their workload with greater speed, reduced costs and allowing the people to focus on the tasks at hand and let us take care of the technological solution. For more information, reach out to us here.

Efficient and powerful AML systems identify the information for Know Your Transaction by using AI further AML technologies. In this way, transaction data can be automatically captured and transaction monitoring can be improved.

In addition to reducing false alarms, more detailed information is obtained to assess whether a suspicious payment is present. Visualization also plays a major role in making the work as intuitive and easy as possible for humans.

Curious? Please contact our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access