24 October 2022, 14:30

Tagline

24 October 2022, 14:30

Tagline

AML Technology is software that supports the anti-money laundering process. It is a form of computer program used by financial institutions to analyze customer data and detect suspicious transactions. Anti-money laundering systems filter customer data, classify it according to the level of suspicion, and examine it for anomalies.

Implementing effective AML programs is relevant. The digital transformation of AML is required to comply with regulations for financial institutions such as banks.

Money laundering and other financial crimes are prevalent all over the world. As new regulations are put in place, the criminals are adapting to this to find new ways around them. Anti-money laundering (AML) systems must be as effective and efficient as possible to reduce the risk of these crimes.

In July 2021, the Financial Action Task Force (FATF) report was published, outlining opportunities and challenges of using new technologies to prevent these crimes. New technologies are constantly being developed to aid AML compliance and this can allow for people to allocate their time differently, to focus on more complex tasks. This blog will discuss some of the common opportunities and challenges for financial crime and AML technology.

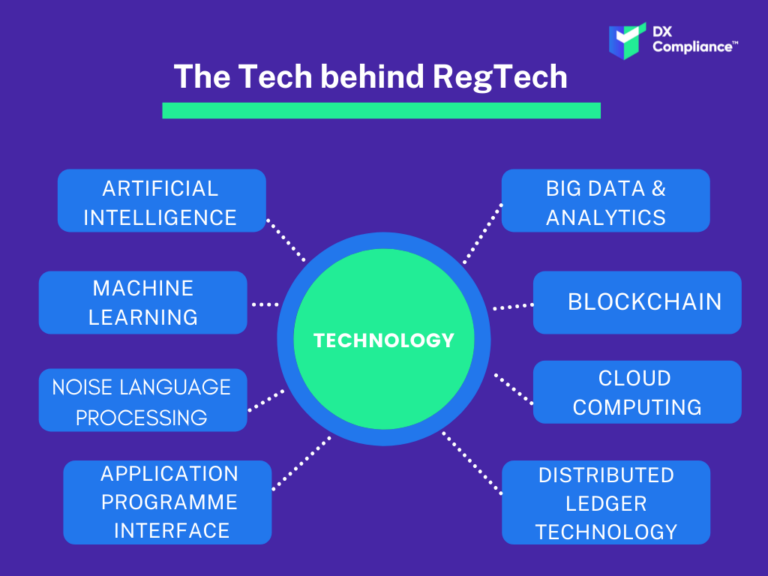

Anti-Money Laundering represents all efforts to detect and prevent financial crimes. RegTech, also known as regulatory technology, is any technology that helps organisations meet compliance obligations. Regtech solutions accelerate and strengthen companies’ processes through automation to meet their AML obligations.

Traditional tools are too inflexible and limited in scope to deal with the ever-increasing AML compliance regulations and so below are some reasons for moving from a human-centred approach to a risk-based approach.

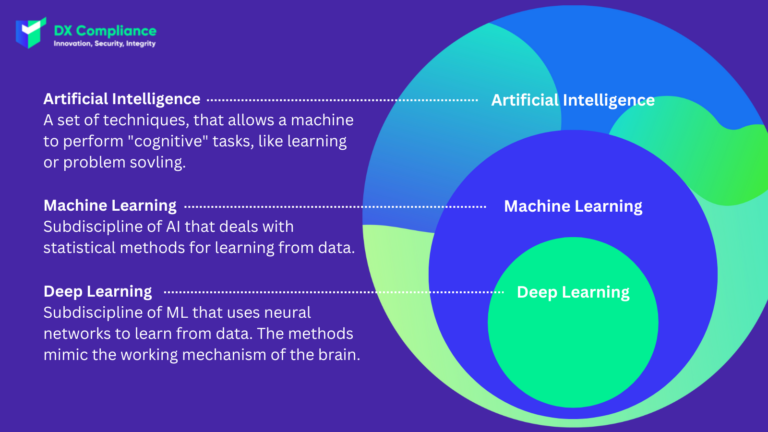

AI is the intelligence demonstrated by machines, rather than by human thinking. The development of AI technology in this field is monumental. AI systems combine intentionality, intelligence, and adaptability to mimic human thinking to perform tasks. AI in AML means learning customer behaviours.

Machine learning, is a subset of AI that trains computer systems to learn from data, identify patterns and make decisions with minimal human intervention. Transaction monitoring and SAR submissions using AI and machine learning tools may be carried out with greater speed, accuracy and efficiency, once the system adequately trained.

Once implemented, AI technologies have the ability to create many opportunities for anti-money laundering compliance, it is not without some challenges as well. The core challenges outlined by the FATF are either regulatory or operational.

The first set of challenges the FATF deal with are surrounding the AML regulation. Regulatory bodies need to give clear direction and support for this AI technology. Supervisors must be able to understand the models used by AI tools to determine their accuracy and their relevance to the identified risks.

AI and machine learning can carry out tasks for anti-money laundering but there needs to be human supervision throughout. There is also a period of adjustment once an institution adapts new technology. This can be a challenge as it will take some time to become an effective practiced procedure

The operational challenges mostly relate to adapting practices to new systems and technology solutions. The systems must be “taught” correctly or else they will continue to recognise patterns and make decisions that are wrong, based on its learning. It is imperative to have that at the forefront when choosing and implementing RegTech processes.

Moreover, there could be some issues related to the costs of new technologies, the ability of actors to understand and train staff to implement them. As the AML landscape is quickly evolving, an issue could also be developed if the current technologies become out-dated and no longer meet regulations, and so require additional investment in newer solutions.

There are also ethical and legal concerns that could be unintended consequences of technology in AML through privacy and data protection. There is a need to develop appropriate government and private sector standards and safeguards to combat these concerns.

An important unintended consequence could come from the way in which the programme was developed. Researchers are discovering that many AI algorithms replicate the developers’ conscious and unconscious biases. This could lead to unfairly targeting and flagging financial activities of certain types of individuals and entities.

The main benefits of utilising technology to improve AML compliance are:

To combat the high levels of false positives seen through traditional AML Transaction Monitoring controls, technology can improve the efficiency for banks and other financial institutions. This type of RegTech applications, such as DX Compliance Solutions, provides a full solution in transaction monitoring. This significantly reduces operation costs with no detriment to the effectiveness through different combined technologies.

Noise Process Learning is a branch of AI that enables computers to understand, interpret and manipulate human language in the same way that a person can. This is used in Transaction Monitoring technology, and it can have great benefit for AML operations. NPL can filter out cases requiring complex investigations and increase conversion rate of alerts into suspicious activity reports.

These combined technologies also allow for SAR submissions to be automated in such a way that it leads to more accurate and efficient working. Application Programme Integration is used as it allows for different systems to communicate through AI and so this is beneficial within ongoing AML monitoring as well.

The application of technology to Customer Due Diligence and Enhanced Due Diligence and ongoing monitoring allows for a more streamlined onboarding processes adapted to the risk and context. These have the potential to improve the customer experience, as well as contribute to more effective anti-money laundering and counter finance terrorist safeguards.

The ability to utilise Big Data Analytics and Distributed Ledger Technology to comb through large data sets that are shared across institutions and geographies. This allows assessments of ongoing enhanced and customer due diligence to be completed, which can be updated to account for new and emerging threats in real time.

DX Compliance is software-as-a-service (SaaS) and provides a full solution Transaction Monitoring through different combined technologies.

DX aims to help achieve regulatory AML compliance by empowering compliance people in AML. We use technology to help complete their workload with greater speed, reduced costs and allowing the people to focus on the tasks at hand and let us take care of the technological solution. For more information, reach out to us here.

Curious? Get in touch with our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access