25 June 2021, 10:53

Tagline

25 June 2021, 10:53

Tagline

The UK has become one of the world’s largest financial service industries and is today’s home for some of the most important and influential financial institutions in the world. UK financial services employ over 2.2 million people and contribute £65.6 billion in tax to the UK economy.

The Financial Conduct Authority is also one of the most active regulators in the World in terms of Innovation. The FCA is the regulator for nearly 60,000 financial services firms and financial markets in the UK and the prudential supervisor for 49,000 firms, setting specific standards for 19,000 firms.

The main role of the Financial Conduct Authority is to maintain the stability of the UK’s financial markets and the safe conduct of its regulated financial service firms.

The financial Conduct Authority is a regulatory body in the United Kingdom but operates independently of the UK Government. It is responsible for the regulation of all financial service activities that either take place or surround UK Based companies and consumers. The FCA create and evaluate frameworks over the regulation of areas around trading, banking and currency.

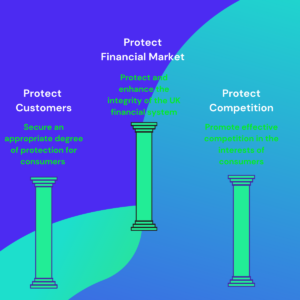

The FCA is to ensure that the relevant markets function with scope over 3 Key pillars that are mentioned here:

While its main focus, is to regulate financial firms’ behaviour and it has the authority to investigate abuse, regulate the marketing of financial products, and manage minimum standards.

The FCA Scope covers regulation under numerous Fintech and Regtech operations, however they primarily apply to the innovation of business and banking systems.

The FCAs aim is to serve the public interest by improving the way financial markets work and how firms conduct their business while adding to those who use financial services, and its mission explains what it prioritises and why. It also describes the framework we use to make decisions, the reasoning behind our work and how we choose the best tools for the job.

Where the FCA is in the common law jurisdiction unlike other Regulators who are in a case law jurisdiction this has no impact on the regulation. The freedom act which is an important pillar on the UKs common law jurisdiction is reflected in the FCAs Mission statement.

The FCA has reacted and acknowledged the volume of investment in technology, since the Global FinTech investment is running at a rate of more than $80 billion a year, with a prediction of RegTech spending predicted to exceed $115 billion within the next four years.

Technological innovation, particularly Artificial Intelligence (AI) and Machine Learning (ML), are changing the ways firms do things — more than three quarters of insurers predict that the underwriting of non-complex risks will be undertaken entirely by AI and almost two thirds of banks expect AI to be used to design new products within the next 10 years.

A Regulatory Sandbox is a framework set up by regulators that enables FinTech start-up’s and other innovators to conduct live experiments in a controlled environment aka a “sandbox”.

And building on from the FCAs innovation approach, they have begun a collaboration with the City of London Corporation to pilot a ‘digital sandbox’. The pilot has provided enhanced support to innovative firms tackling challenges caused by the coronavirus (Covid-19) pandemic.

The pilot sandbox gave participants access to a range of development tools, such as synthetic data assets for testing and developing PoCs, an API marketplace, a coding environment, as well as access to expert mentors and observers.

The Digital Sandbox pilot focussed on 3 pressing areas and we want to provide the necessary support for each, in terms of supplying relevant data sets and expertise.

If you work in any area of the financial, business or RegTech industries you will need to be familiar and acquainted with the Financial Conduct Authority (FCA). As the FCA since 2015 has established the “Call for Input” for how they can support and developed the future of the RegTech industry in the UK.

Now, knowing the role and what the FCA is we look at the enforcement of its governance. Here is the most recent edition of the FCA Guide to Enforcement document from June 2021. This publication outlines the most areas that are regarded or considered as high risk for misconduct: Serious failings in a firm’s systems and controls; including governance and failings by senior managers

On January 10, 2020, the changes made by the United Kingdom Government’s Money Laundering FCA Regulations came into force. The UK’s AML regime has been updated to include the Financial Action Task Force (FATF) in general and the 5th Money Laundering Directive of the EU.

The regulations mainly cover:

On June 21st 2021, the FCA released its guide to countering financial crime risks (FCG). The FCS looks at key aspects of firms’ efforts to counter different types of crime including Anti Money Laundering (AML). It is aimed at firms big and small; material will not necessarily apply to all situations.

The FCG also contains guidance on how firms can meet the requirements of the Money Laundering Regulations and the EU Funds Transfer Regulation. While other relevant parts of the guide that refer to the Money Laundering Regulations may be ‘relevant guidance’ under these regulations.

However, the FCA does not attempt to set out all applicable requirements and should be read in conjunction with existing laws, rules and guidance on financial crime.

The FCA provides a wide and refined regulations and governance over the UK and its EU counterparts in order to protect its consumers, business and bodies from financial crime activities while increase international markets. RegTech software are continuously growing to protect your business from these activities and offer solutions to these problems.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access