22 February 2021, 15:42

Tagline

22 February 2021, 15:42

Tagline

Despite the desire worldwide to foster innovation, only a handful of jurisdictions have started to introduce regulatory Sandboxes. As a first -mover in Europe the FCA launched the first regulatory Sandbox in May 2016.

Many other authorities maintained an initially sceptical stance, at a semi-publich conference in 2018, the leadership of Germany’s regulatory authority BaFin stated that they didn’t see this as an option and considered it a potentially high risk operation.

Interestingly, this argument from regulatory authorities is one which pushes the boundaries of their competency. Innovation within a market or a country is not something that can only be approached by these authorities. Governments, Central Banks and the wider public have a vested interest in innovation taking place within their country. The trick, as with most areas in the financial services industry, is to balance to potential gains with appropriate mitigation of risk.

Regulatory Sandboxes are designed to be this mitigation, they are however still in their infancy, and have seen as many limitations and constraints as they have successes.

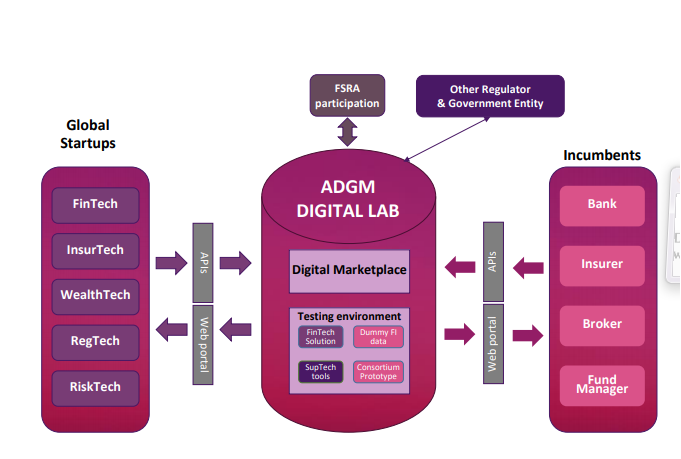

As a first mover in the UAE, the ADGM Digital Lab is aiming to act as a Superpowered Sandbox, going beyond the traditional ‘permission to act’ by actively fostering innovation in supplying participants with access to things that are usually missing for most companies to get the most out of their Sandbox experience.

The ADGM Digital Lab is an important Sandbox that will bring more Innovation to the wider region. As most jurisdictions have their own approach the concept of a global sandbox is likely decades away from becoming a reality, and arguably not a big necessary

The Digital Lab is a digital platform where financial institutions (“FIs”) and FinTech firms can collaborate, test and develop innovative solutions for the financial services sector, in a controlled environment supervised by the Financial Services Regulatory Authority (FSRA).

The ADGM Vision for technology-first and digitally native financial services market is fully supported by the Abu Dhabi Investment Office (ADIO).

The Digital Lab, a Ghadan 21 accelerator programme initiative, has been developed in conjunction with ADIO.

THE ADGM is now 5 years old and RegTech plays a major role for FinTechs so it does for regulators and government bodies.

ADGM launched the first regulatory sandbox (known as the Regulatory Laboratory or RegLab in short) in the MENA region in 2016 to allow FinTech start -ups to test and deploy their solutions in a controlled environment under the supervision of the regulator.

Today, ADGM has the most comprehensive suite of regulatory frameworks in the region catering to a diverse range of digital financial services, from digital banking and payments, to digital assets, securities and robo-advisory. Many start-ups have benefitted from the innovative, progressive and robust regulatory frameworks offered by ADGM.

The RegLab is one of the most active sandboxes in the world, and have seen start-ups in the programme successfully deploy their solutions in the wider markets

1. Enlarge Market Reach to Deploy and Scale Solutions: Connect and collaborate with FIs (locally and cross the border to deploy solutions to a larger client base).

2. Build Market Credibly Among Industry and Investors: Showcase tried and tested solutions, shortening the procurement process for faster industry adoption and time to market. Increase credibility of FinTechs, facilitating opportunities to new FIs and raising visibility among investors to help them grow

3. Access to Regulatory Guidance and Industry Resources: Receive guidance on compliance issues from the community and participating regulators. Access to resources such as data, APIs or reference architectures which enables entrepreneurs to create solutions that are more readily integrated with the existing technology stack.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access