4 October 2022, 15:10

Tagline

4 October 2022, 15:10

Tagline

Performing Watchlist and Pep and Sanctions Screening is not only important because it is a legal duty or part of the KYC (Know Your Customer) and EDD (Enhanced Due Diligence) Process, it also saves and protects your reputation as you perform on your Customers the necessary Due Diligence and Enhanced Due Diligence.

In this blog we will deep dive into the World of Sanctions Screening.

The term targeted sanctions means that such sanctions are imposed against specific individuals or groups, or undertakings or entities.

The term targeted financial sanctions includes both asset freezing and prohibitions to prevent funds or other assets from being made available, directly or indirectly, for the benefit of individuals, entities, groups, or organization who are sanctioned.

We highly recommend you reading the Guidance on Targeted Financial Sanctions. Especially, if you are a designated non-financial business and profession (DNFBPs) or a financial institution. Helpful resources can also be found here.

There are 2 main types of financial sanctions: Asset freezing and the prohibition to offer funds and services.

The purpose of TFS is to deny certain individuals, groups, organizations, and entities the means to violate international peace and security, support terrorism or finance the proliferation of weapons of mass destruction.

To achieve this, it seeks to ensure that no funds, financial assets, or economic resources of any kind are available to listed actors for so long as they remain subject to the restrictive measures.

It is important note that TFS restrictions published by the UN and the Local Terrorism List are subject to change.

Financial Institutions and DNFBPs are obliged by law to apply policies, procedures and controls to implement TFS to those sanctioned and referred in the UN List and the Local Terrorism List.

Any Person, found to violate and/or be in non-compliance with the obligation or failing to implement procedures to ensure compliance may face imprisonment or a huge fine.

A sanctions list is a list containing the names of individuals and organizations linked to terrorism, financing of terrorism or proliferation of weapons of mass destruction and its financing, and that are subject to sanctions imposed as per UNSCRs and decisions of the Sanctions Committee, along with information related to such persons and reasons for their listing.

These sanction lists include names of individuals, legal entities and groups that the UAE or the UN believe are detrimental to national or/and global peace and security. These individuals or legal entities or groups are mostly involved in acts of terror and violation of International Law.

The UNSC has a UN Consolidated List of all the sanctioned individuals, entities, or groups designated by the United Nations Sanctions Committees or directly by the UNSC.

In addition to that are mostly country specific lists like the SECO List (Switzerland), the HMRC Treasury List (UK) and The UAE Local Terrorist List (UAE) of all the sanctioned individuals, entities, or groups designated by the UAE Cabinet.

Our top tip for UAE updates: Register at the Executive Office website to receive automated email notifications. This registration is aimed to help financial institutions and DNFBPs to receive updated and timely information about the listing and de-listing of individuals or entities in the Local Terrorist List and in the UN List.

The sanction screening software DX CheckAML can help you performing checks on people and businesses in seconds rather than hours.

In the easy-to-use tool, you simply enter the information about the person or organization you want to check. Then you will already get the result. It doesn’t get much faster and simpler than that, does it?

To ensure global compliance, we screen over 400 of lists around the globe, including:

EU consolidated List of Sanctions

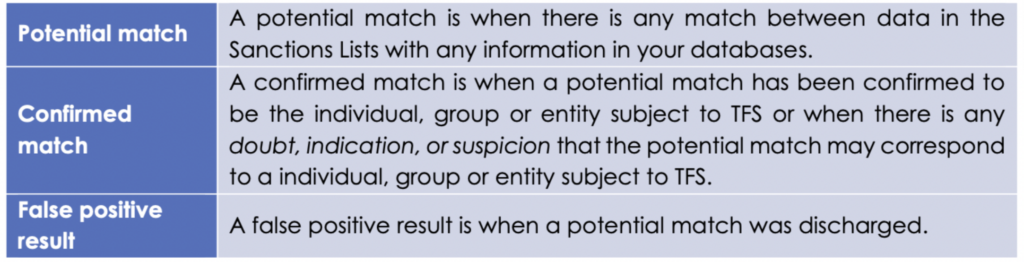

For starters: Screen your customers and undertake ongoing and daily checks to the databases to identify possible matches with names listed in the Sanctions Lists issued by the UN List or the UAE Local Terrorist List:

Note: Initial screening must be performed PRIOR to the onboarding of a customer and/or facilitation of an occasional transaction. Thereafter, screening should be done daily at the institution’s own initiative. The Sanctions Lists are continuously updated and available on the Executive Office’s website and the UN website online.

If a current or former customer with whom the financial institution or DNFBP has or had dealings (i.e. business relationship or facilitating of an occasional transaction) became listed. A financial institution or DNFBP must freeze any assets and must not offer access to any additional funds or services and must immediately inform the Supervisory Authority or the Executive Office.

At DX Compliance, we use innovative technology to make AML compliance as efficient and easy as possible for you.

Our sanction screening software CheckAML enables PEP and sanction screenings as well as risk assessment in a few seconds.

Are you interested? Contact us!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access