15 November 2022, 9:30

Tagline

15 November 2022, 9:30

Tagline

Criminals use the money mules for money laundering to turn money earned illicitly into clean funds and back into the legal economy. Money muling occurs when criminals recruit a money mule to transfer illegally obtained money between different payment accounts, very often in different countries. The meaning behind money muling comes from the animal mule. In the same way that the mule animal is used to carry goods and people across terrain, money mules are used to move money from one account to another.

Criminals often use money mule to wash the money they have laundered through drug trafficking, fraud, arms, and human trafficking. Money muling is an effective way of washing dirty money because it allows the criminals to remain anonymous. Anti- Money Laundering regulations are not effective in catching money muling because of the use of mules. When criminals choose mules, they choose innocent, inconspicuous accounts with no criminal record because they are less likely to be caught. This prevents the authority from being able to trace the money laundered. The FATF published in 2018, Professional Money Laundering, including information about Money Muling.

The process of money muling depends on the ability to find an individual to transfer the funds from one account to another. Mules are recruited by criminals, and these mule recruiters are also known as mule ‘herders.’ The mules open a new bank account and receive money from a third party in their bank accounts, then illegally transfer them to someone else, allowing the criminals to remain anonymous while moving funds around the world. The mules receive compensation for their involvement, usually in the form of money.

People can agree to become money mules without knowing the purpose of the transactions. Some do not know that they are participating in criminal activity. On the other hand, some people are aware of the implications but do it for the monetary reward. It is possible that they see their involvement in the crime as a low risk of being caught.

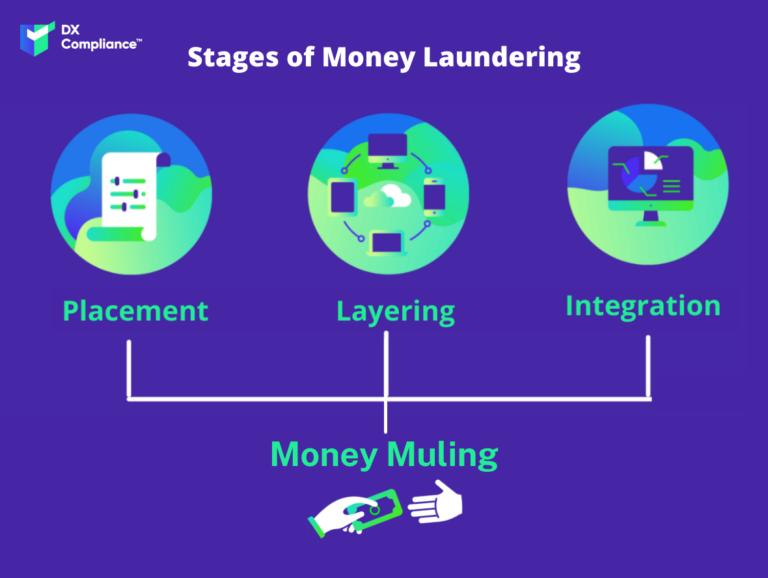

The new bank accounts to transfer the money, opened by the mules, serve as the initial layering stage in the laundering process. The stage of layering involves concealing the source of the money through a series of transactions. This allows the original illicitly earned money to be integrated back into the economy.

Criminals, or muling herders, can target individuals for money laundering schemes through various methods.

Some common methods used are through:

Anyone can be approached to become a money mule. They are attracted to individuals with clean records who are inconspicuous and would not generally be at risk for money laundering. Criminals can recruit anyone with the promise of easy and quick money.

Those most likely to be targeted are newcomers to the country and unemployed people, students and those in economic hardship. The most likely targets are people under 35 years old. Recently, criminal groups have begun recruiting younger generations from 12 to 21 years old, through social media channels.

With its increase in popularity, virtual currency can lend itself to money muling. Money mules transfer illicit funds to bank accounts as well as through cryptocurrency accounts. Without official regulation, cryptocurrency can lend itself to be a platform that attracts criminal trading. Read more about Cryptocurrency here.

More than 90% of money mule transactions identified through the European Money Mule Actions are linked to cybercrime. Cryptocurrencies do not require identification or verification and it can be exchanged into fiat money. The higher level of anonymity within cryptocurrencies than traditional payment systems is a huge attraction to criminals. The use of virtual currency platforms, such as Bitcoin, to launder money just adds to the complexity to conceal the original source of the funds.

Money laundering through muling is a criminal offence globally. There are punishments for those running the operation, the herders, can be prosecuted and imprisoned if they are caught. The mules involved are also breaking the law, even if they are not aware of the illegal activity. The victims of money muling are at risk as the security of their is compromised, and their personal identity information is in the hands of criminals. They may have to pay the money lost by the victims if money mules are caught.

In the past, money mules have been viewed as low-level offenders, transferring small amounts of cash. However, organised, sophisticated money mule schemes have evolved as a Professional Money Laundering mechanism.

As the regulatory landscape evolves, criminals find new ways of adapting and getting around them. Although money muling is changing, there are certain identifiers and money muling red flags to look out for.

As a bank and other financial institution, there are guidelines to help prevent money mules. Although Know Your Customer (KYC) and Enhanced and Customer Due Diligence (EDD and CDD) steps are important, it is not enough to determine the customer’s risk, and the transactions must be scanned. Banks can perform these screening operations with AML Transaction Monitoring. Artificial Intelligence can lend itself to ongoing transaction monitoring. Effective transaction monitoring must be rigorous in its continuous checking for suspicious activity. It should not look at a single transaction in isolation but should utilise as much data as possible to paint the fullest picture possible.

As an individual, there are also ways to help prevent money muling. One should never give bank account or other personal details to anyone you do not know or trust. Secure your bank account by ensuring never to disclose your online banking login details, PIN, CVV number, etc. Be very cautious of unsolicited emails or offers made over social media or in person, promising easy money.

In financial institutions like banks, criminals use money mule accounts to carry out money laundering activities. Due to money mules, organizations may be subject to regulatory penalties and money laundering offenses. DX allows for businesses to meet their global and local AML obligations.

Artificial intelligence can be developed to stop money muling. Technologies to prevent money muling such as, Software programmes like DX Compliance Solutions, uses the most effective technology to irradiate human error within AML. An effective transaction monitoring program enables LFIs to detect, investigate and report suspicious transactions. Find out more about DX Compliance Solutions here.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access