16 June 2021, 14:29

Tagline

16 June 2021, 14:29

Tagline

Australia has begun to emerge as a major regulatory technology hub with now, 80 established RegTechs in the country, making it the third-largest in the world behind the United States and UK.

The RegTech Association event -#REGTECHEDGENOBORDERS | AML, CTF AND SANCTIONS RISK, occurred digitally on the 17th of June, 2021 at 7:00am (IST).

Spending within the RegTech industries is expected to exceed $130bn by 2025, and to grow by 290% from the $33bn spent in 2020, this growth will be driven due to the greater use of AI to automate highly manual tasks and the transition to digital onboarding, which emerged as a critical capability in the wake of the pandemic.

The growth of RegTech has also resulted in the need for compliance and governance over regulations. As the global spend on financial crime compliance across all financial institutions reached $213.9 billion in 2021, surpassing the $180.9 billion recorded in 2020. The majority of this sizeable year-over-year increase is represented by Western Europe and the United States.

However, the importance of the event surrounds this and the increase of fines and breaches from the realm of RegTech companies. With a particular focus in Australia, the AUSTRAC who are responsible for preventing, detecting and responding to criminal abuse of the financial system have highlighted large and future fines to the breaches of these regulations

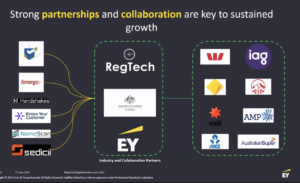

The RegTech Association event was designed to showcase RegTech solutions that address the global challenges across a complex regulatory landscape. The event primarily, focused on key risk areas across RegTech. The event was moderated by the Regtech Association and EY with also government associates such as – AUSTRAC .

DX Compliance Prem Ipe, CPO, will be hosting at the RegTech Association at event. A special thank you was also given to Enterprise Ireland who sponsored and facilitated our contribution to this event.

From this event it has become more evident that :

We take a look at the industry map here:

This classic RegTech map does provide a customer and a organisation the knowledge of whos in the field of Regtech, yet does not cover who they are, what they provide, the software offered and main USP points within the RegTech industry. This is where we begin to look at the RegTech Association in Australia and their involvement to this issue.

The RegTech Association was founded in Australia, in 2017 as a non-profit organisation that focuses on what is needed to support the growth of the sector and to accelerate RegTech adoption.

The Association brings together government, regulators, regulated entities, professional services and founder-led RegTech companies to ensure a collaboration between all of the parties, promoting the RegTech industry as widely as possible, resulting in action in the uptake of RegTech proof of concepts and deployed RegTech solutions across the eco-system.

As we’ve highlighted through this blog, Australias Reg and Fintech scene is rapidly evolving and becoming a international player.

However, there has recently been huge fines hidden within the banking sector. Recent scandals like:

NAB’s anti-money laundering compliance

While the Australian Fintech industry continues to grow rapidly it also attracts global investment and recent activities in the M&A . In total the Australian Fintech Scene generated in 2020 an estimated revenue of $ 4.2 billion dollar.

It is important to also note that the global industries of RegTech and Fintech are growing, and are expected to be worth over USD 300 billion in the next 3 years.

The reason for that is the digitalisation of traditional banking together with the shift also due to the Millennial Generation will bring higher expectations with both technology and User Experience.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access