1 June 2022, 11:27

Tagline

1 June 2022, 11:27

Tagline

AML Technology is software that supports the anti-money laundering process. It is a form of computer program used by financial institutions to analyze customer data and detect suspicious transactions. Anti-money laundering systems filter customer data, classify it according to the level of suspicion, and examine it for anomalies.

Implementing effective AML programs is relevant. The digital transformation of AML is required to comply with regulations for financial institutions such as banks.

In our blog article RegTech and AML Technology, we explain the technological part more detailed. However, we give a rough overview about the technologies that help comply with existing AML regulations:

Financial institutions often have a very large number of customers. Keeping track of all of them would be nearly impossible without the help of automated AML screenings. The focus is on the concept of “Know Your Customer” (KYC). This covers the process by which institutions verify the identity of customers and assess the risk of working with them.

Thanks to AML Technology, customers are automatically screened against national and international databases. These lists can include sanctions, watch lists, politically exposed persons (PEPs) and negative news.

The digital edge makes this easier than ever before! DX Compliance’s latest product CheckAML, for example, enables screenings in seconds. Thousands of data lists are compared in the process.

On the one hand, of course, this helps the financial institutions. On the other hand, it brings clear advantages for Designated Non-Financial Businesses and Professions (DNFBPs), such as law firms. Because no large system has to be integrated, and the online access is even possible as pay as your go.

AML considers not only individual transactions, but also patterns of unusual or high-risk transactions. AML Technology makes this monitoring much easier as it detects high-risk transactions and patterns automatically.

As with screening, transaction monitoring has the advantages of higher efficiency and lower error rates. In addition, with providers such as DX Compliance the advanced case management system makes it easy to investigate and report suspicious activity. It can even fill out suspicious activity reports (SARs) for you.

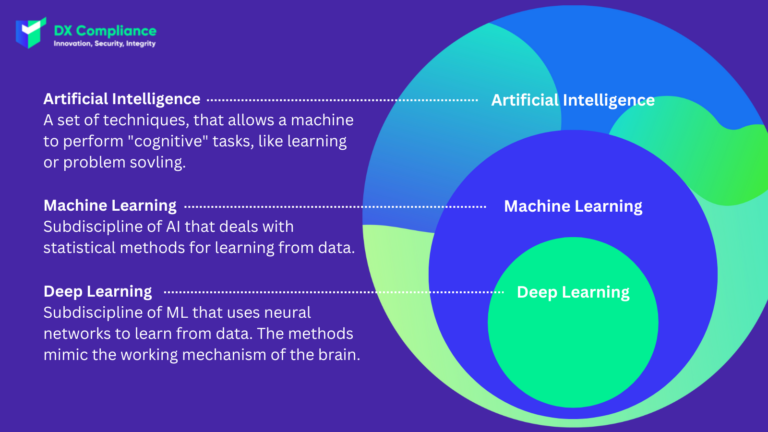

To put it simply, Artificial Intelligence (AI) refers to machines that can learn. Your computer can’t think like you, but it can analyze a lot of data quickly and use algorithms in ways that humans can’t. This can also be used for AML to make compliance more effective and less time-consuming.

Artificial intelligence is not a stand-alone tool, but rather a feature of automated AML screening and transaction monitoring. When applied properly, it is extremely powerful and can automate AML processes, reducing inefficiencies and human error.

As part of artificial intelligence, machine learning refers to software programs that use data and algorithms to identify patterns in human transactions. Over time, the program can detect changes in customer behavior, making it easy to identify suspicious activity.

These programs monitor ongoing transactions and learn to predict financial behavior. If a customer’s previously unremarkable financial activity changes, the software will alert you to these suspicious transactions. This can include unusually high deposits and withdrawals, a change in the frequency of transactions, and more.

Machine learning reduces your losses from money laundering by alerting you to potential problems that you might not otherwise detect. It also helps reduce false positives by helping to optimize your AML rules over time.

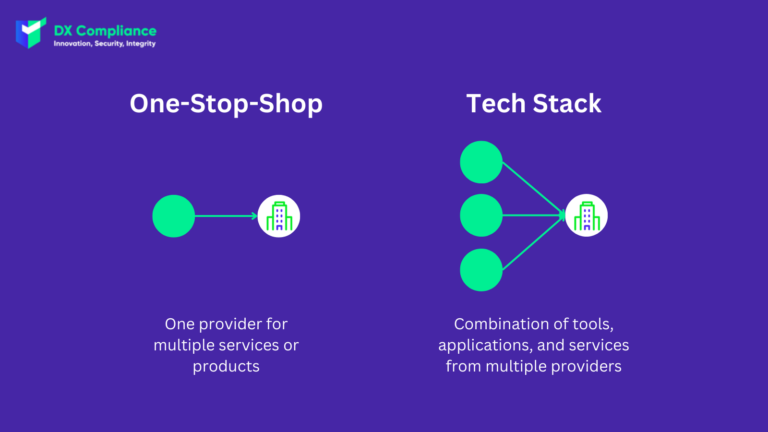

A one-stop-shop is a business that offers multiple services or products to customers. This means that an organization contracts a provider who is responsible for all AML technology parts and beyond.

In contrast to the One-Stop-Shop approach, Tech Stack refers to a a combination of tools, applications, and services. This means that an organization purchases solutions from multiple vendors.

Within the AML technology strategy filed, the fin-crime Tech Stack vs. the AML One-Stop-Shop is a discussion that is going one now for many years. While traditionally specialization was key due to the limit of hardware and software, there is now a bigger group of companies who are on the rise of the one-stop shop for AML and included this mode of thought into their company mission. This “platformization” of anti money laundering and anti financial crime software can be in favour of a customer depending on where he is on his tech journey.

Thus, on the one hand, one solution is that there is “one platform for everything”. At first glance, this seems simple. But in reality, it may not offer customers what they really need. It also carries some risk, which means technical dependence on a single provider, rather than sharing the risk between several best-of-breed providers. It’s different when different platforms are sourced. This also suggests the platform age, that everyone and every department has their own platform.

The three lines of defense of corporate structures of fintechs and traditional financial service providers undergoing digital transformation must position themselves in terms of vendor screening. They need to look at the company from this point of view, whether it is a complete solution or a solution for a specific need.

But is the decision really made based on the needs of the organization? In the past, when a system change was needed, for example, the decision was often difficult to make. This is because the old legacy vendors were not very integration-friendly. That has changed today, giving the highly specialized AML tech stack folks a big advantage.

We at DX believe in the future of AML in terms of highly specialized vendors which leave no room for the one-shop-fits-it thinking.

The reason why we are that opinion is data. The power of data when it comes to purchasing anti financial crime software shows clearly that organizations can’t scale with a one-stop-shop solution.

The advantage of the Tech stack lies in its detail and the level of risk that is split between different tech vendors who integrate all, with each other. And while this sounds like a lot of work it’s actually not.

Solutions work differently (I always compare Transactions Monitoring with the Search engine markets of the 90s!) and while we see this in many different markets a normal Fintech mostly starts with the onboarding and the KYC Part. Onboarding customers and a smooth customer journey are important to gain competitive advantages.

Every interaction with the customer is meaningful because it gives you the chance to leave an impression.

The customer onboarding process is the start of a relationship. It includes various activities, such as evaluating the customer’s request, legal aspects, opening the account, and making it operational. The onboarding process for financial institutions is mainly checking a lot of information to comply with complex regulations that are different from country to country.

Here it is important to consider the customer’s perspective. For example, if the screening process takes a long time and the customer can access the services much later, this has a negative impact on the customer experience.

Thus, not only the number of clicks to open an account but also the customer journey is relevant.

Build your AML Tech stack from the customer journey while being focused on the problem. The problem for most organizations lies in the ongoing behavioural part as no money launderer is laundering money under his own name, so once the customer is onboarded is the customer actually doing what other similar customers are doing? Is it different? Is it suspicious? Do you need to submit a SAR/STR?

The power lies in the transactions data and this obviously can be combined with the powerful effects of building your AML Tech stack and an AML technology Strategy.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access