26 October 2022, 11:52

Tagline

26 October 2022, 11:52

Tagline

TARGET2 is the real-time gross settlement system (RTGS) introduced and still operated by the Eurosystem. It is the leading European platform for the settlement of large-value payments and is used by both central banks and commercial banks to settle payments in euro in real time.

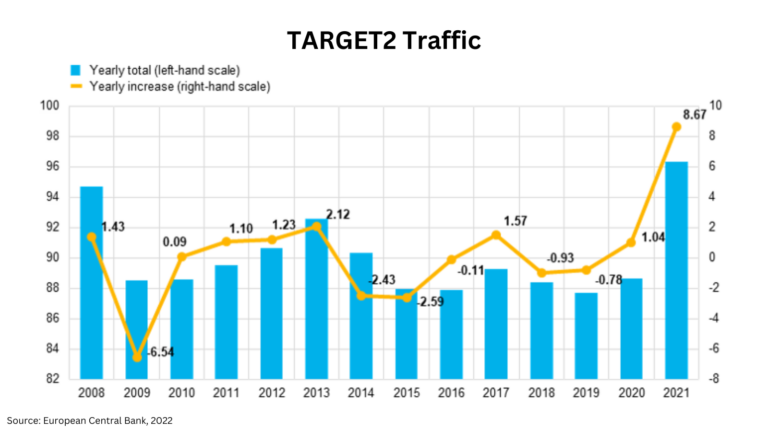

To highlight the enormity with numbers: In 2021, there was a traffic of more than 96 Million Euro that covers an yearly increase of 8.67 %. More than 1,000 banks use TARGET2 to initiate transactions in euros either for themselves or for their customers. Taking into account branches and subsidiaries, more than 52,000 banks and all their customers worldwide can be reached via TARGET2.

TARGET2 processes payments related to Eurosystem monetary policy operations as well as bank-to-bank and trade transactions. Central banks and commercial banks can submit payment orders in euros to TARGET2, where they are processed and settled in central bank money, i.e., money held in an account at a central bank.

To answer the question of relevance, we start with the importance of payment systems:

Modern economies rely on the safe and efficient flow of transactions. Payment systems ensure that money can flow in the economy. TARGET2 is a payment system that allows banks in the EU to transfer money among themselves in real time. This is known as real-time gross settlement (RTGS).

The ECB has a strong interest in ensuring that payment systems and other market infrastructures function smoothly and effectively to safeguard financial stability in the euro area. This makes TARGET2 an important building block of financial integration in the EU. It enables the free flow of money across borders and supports the implementation of the ECB’s single monetary policy.

According to the European Central Bank, Target2 has the following objectives:

By meeting these objectives, TARGET2 enables payments to flow safely and efficiently across Europe and contributes to the stability of the euro.

The Eurosystem consists of the European Central Bank (ECB) and the national central banks of the 19 European Union member states that are part of the euro area. Participation in TARGET2 is mandatory for new member states joining the euro area.

However, others may participate beyond that:

Other financial institutions can connect to TARGET2 through a participating central bank. In doing so, they can choose between different access options:

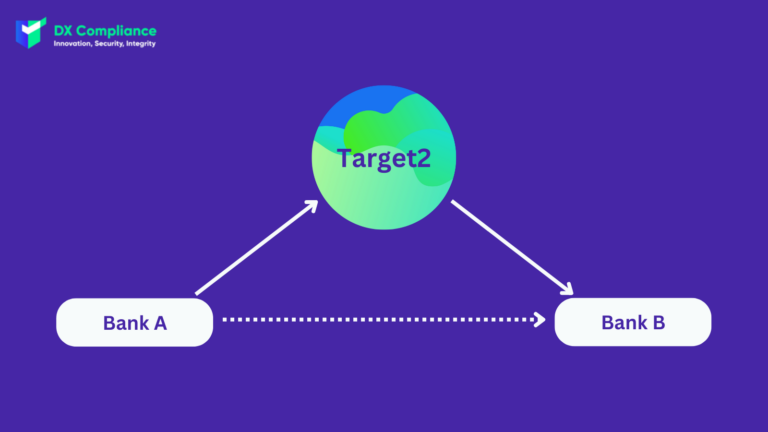

In simplified terms, Target2 works as follows:

As described in simple terms above, payment orders are submitted to the Target2 platform for processing and are settled successively in central bank money with immediate finality. There is no upper or lower limit for their value.

The availability and cost of liquidity are two critical factors for the smooth processing of payments via Target2. TARGET2 has a number of features that enable efficient liquidity management. These include, e.g.:

TARGET2 is open for the processing of payments every working day from 07:00 to 18:00 CET. The system is closed on the following days:

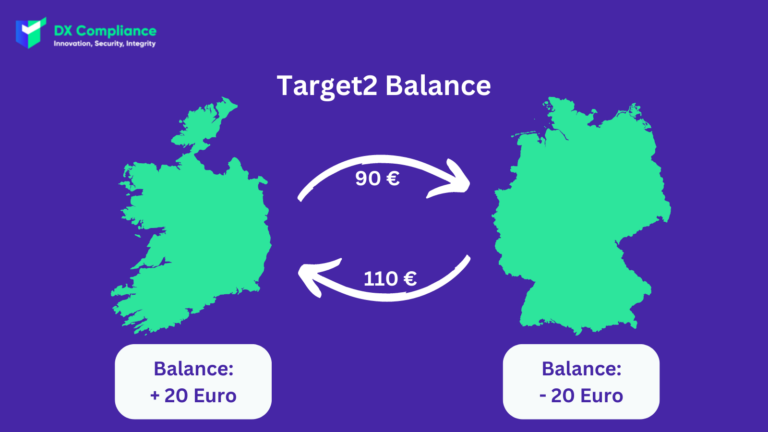

When money is sent between countries, each country produces a result of the ratio of what they sent away and what they received.

The net flow of money between two countries (i.e., the sum of the money received minus the sum of the money sent) is recorded in the balance sheets of the national central banks of the two countries involved. This occurs regardless of whether the transaction was initiated by a commercial bank or the central bank. The accumulation of these flows over time are the TARGET2 balances. The ECB also sends and receives money across borders to carry out its monetary policy, so it also has its own TARGET2 balance.

To avoid each euro area central bank having a separate balance with all other euro area central banks and the ECB, all bilateral balances are combined into a single balance with the ECB at the end of each day.

In short, if a country’s banks have sent more money in total through TARGET2 than they have received, then that country’s central bank will have a negative balance. If they have received more than they have sent, the central bank would have a positive balance. If outflows and inflows were exactly equal, that central bank’s TARGET2 balance would be zero.

The accumulation of money flows over time leads to TARGET2 balances.

DX Compliance will be enabling Target2 integration based on the European Union timelines for our customers.

Customers using the DX Compliance Transaction Monitoring Platform will be able to use the DX Compliance Target2 based on the European Union timelines.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access