1 May 2022, 23:08

Tagline

1 May 2022, 23:08

Tagline

Every year millions of migrants worldwide illegally cross the borders of a country in search of a better future. They often rely on people smugglers to enter their destination state. According to FATF’s report on ML-TF Risks Arising from Migrant Smuggling, the proceeds generated by this illegal activity are estimated to exceed USD10 billion per year.

Migrant smugglers operate on different “business models”, ranging from a loosely connected smugglers that offer travel and related services, to more sophisticated and densely linked smuggling networks in areas with strict law-enforcement strategies.

Migrant Smuggling Statistics by Statista

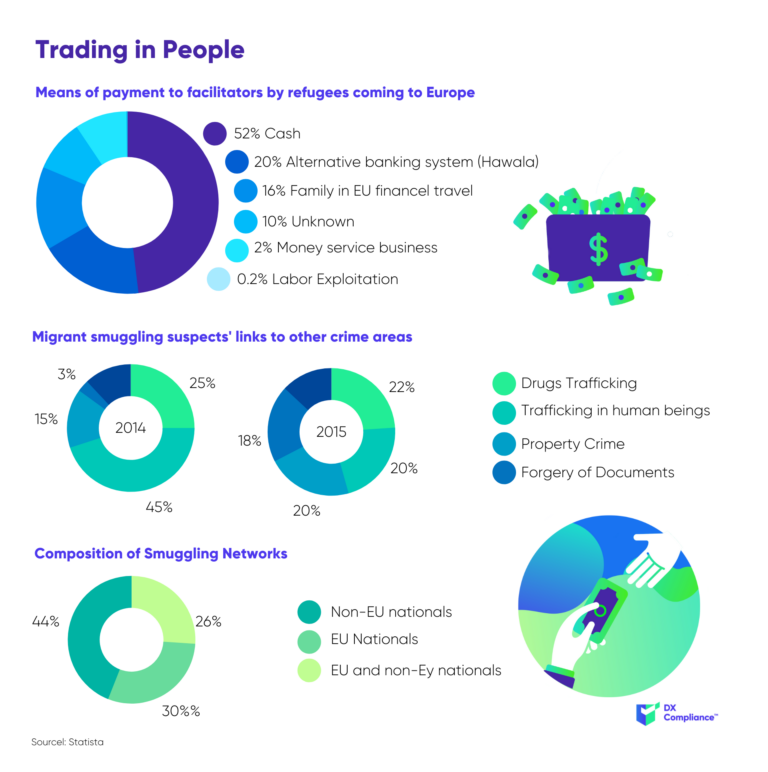

Migrant smugglers are predominantly paid in cash. They avoid depositing their proceeds into a bank account and rely on cash to finance their living costs.

In the instances where money needs to be transferred between jurisdictions, migrant smugglers usually use informal money transfer system, known as hawala. These transactions are entirely out of the radar. Whenever they make deposits into a legitimate bank account, they engage in an activity known as smurfing – they make a large number of small amounts of deposits to avoid suspicion.

Migrant smugglers frequently engage in trade-based money laundering by using legal businesses such as retail, wholesale, financial intermediation services, food premises, travel agencies, transport companies and others. They often rely on professional laundering networks and outsource their money laundering activities.

Lastly, migrant smugglers invest their profits in real estate, high value goods, and legal businesses. They often use a combination of the aforementioned money laundering methods.

The money handling methods used by migrant smugglers make it extremely difficult to detect financial flows. The reliance on cash and unofficial banking methods are a major obstacle when it comes to exposing their illegal activities. There are, however, several indictors highlighted by FATF that could suggest suspicious activity:

At DX Compliance, we use artificial intelligence to monitor online transactions. Our anti-money laundering software detects suspicious patterns of activity in real-time. Our transaction monitoring solution enables LFIs to detect, investigate and report suspicious transactions, which in turn have the potential to trigger migrant smuggling investigations.

Both bank and nonbank institutions should have set anti-money laundering regulations in place. Entities can use AML software or databases to cross-reference their customers and to monitor and report suspicious behavior. Staying up to date with current security measures is needed to effectively comply with national and institutional regulations and efforts to stop money laundering/terrorist financing linked to migrant smuggling.

To read more about how transaction monitoring works in AML software, click here!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access