6 October 2022, 11:31

Tagline

6 October 2022, 11:31

Tagline

Money laundering (ML) and terrorist financing (TF) are taking place more and more globally. Accordingly, anti-money laundering and counter-terrorist financing (AML/CFT) laws are also evolving. There are more and more regulations regarding country aspects.

Under money laundering regulations, banks and other financial institutions are required to conduct enhanced due diligence (EDD) on any business relationship with a person located in a high-risk third country. The enhanced vigilance requirements are essentially additional checks and control measures.

High-risk jurisdictions are countries with significant strategic deficiencies in their anti-money laundering and counter-terrorist financing regulations/measures.

These countries are subject to increased monitoring and are included in various lists by governments and international bodies.

The AML high risk jurisdiction countries list is intended to contribute to risk minimization. Therefore, it is also used in AML Transaction Monitoring or Risk Assessment. A transaction or a person with a high risk country as a attribute will automatically be assigned a higher risk. This means that the Transaction Monitoring will give an alert.

Beyond that, there are other overarching goals. For example, the EU Commission mentions the following:

There are various governments and institutes that keep a list of high-risk countries. These include for example the FATF’s “gray” and “black” lists, the Basel AML Index, and the classification of the European Union, the United Kingdom, and the United States. But the lists of the European Union, UK and US are almost the same as FATF lists because they follow the same logic. Thus, the FAFT lists will be focused in the following.

The FATF is the most important international body for identifying high-risk countries, i.e., countries with strategic AML/CFT deficiencies. It compiles the public documents called blacklist and the greylist. These are updated three times a year. But what is the difference between the blacklist and the greylist?

The FATF works with high-risk countries to address deficiencies that pose a risk to the international financial system.

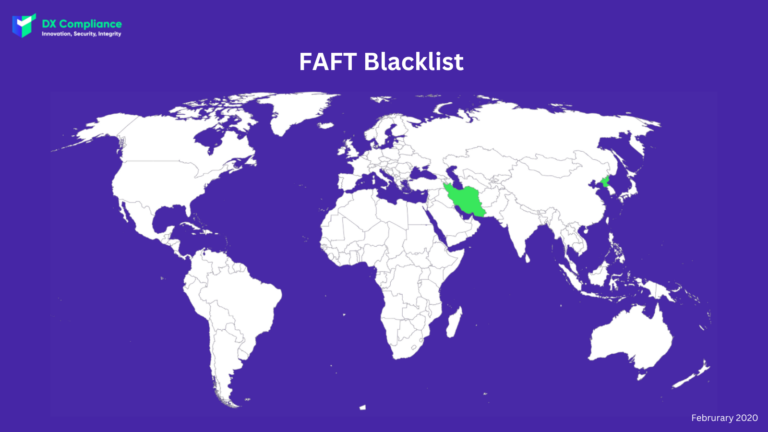

The Blacklist is the statement “High-Risk Jurisdictions Subject to a Call for Action” (formerly known as the “Public Statement”). It identifies the countries or jurisdictions with serious strategic deficiencies in combating money laundering, terrorist financing, and financing the proliferation of weapons of mass destruction.

For all countries designated as high-risk, the FATF calls on and urges all members to apply enhanced due diligence measures. In the most serious cases, countries are asked to take countermeasures to protect the international financial system from the ongoing money laundering, terrorist financing, and proliferation financing risks posed by the country.

The FAFT blacklist includes as jurisdictions with serious strategic deficiencies in combating money laundering, terrorist financing, and financing the proliferation of weapons of mass destruction two countries:

Please note: Since February 2020, the FATF has paused the review process for blacklisted countries in light of the COVID-19 pandemic. The latest statement is dated February 2020, and while the statement may not reflect the latest status of Iran’s and the Democratic People’s Republic of Korea’s AML/CFT regimes, the FATF’s call for action against these high-risk countries remains in effect.

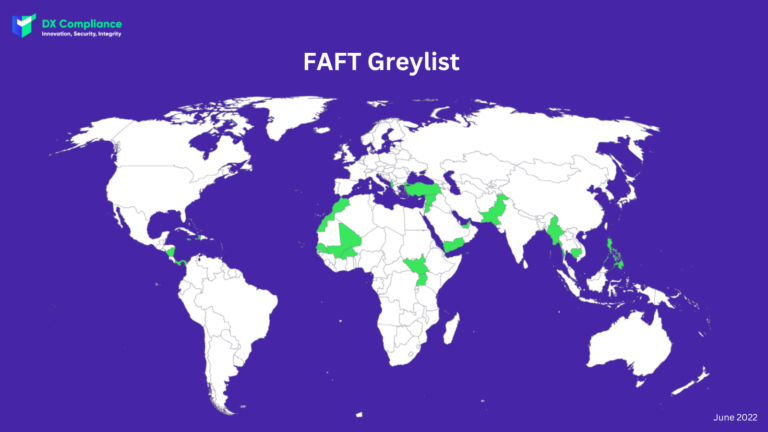

The Greylist is the Jurisdictions under Increased Monitoring statement (formerly Improving Global AML/CFT Compliance: On-going process). It includes identified countries that are actively working with the FATF to address strategic deficiencies in their AML/CFT systems. When the FATF places a country under enhanced surveillance, it means that the country has committed to addressing the identified strategic deficiencies within agreed deadlines and is subject to enhanced surveillance.

FAFT’s greylist with jurisdictions under increased monitoring includes a total of 23 countries:

The question of how long it takes to get off the greylist with the countries under increased monitoring is shown with the Malta example:

In June 2021, Malta was placed on FAFT’s gray list. This was because concerns were raised about Malta’s regulatory infrastructure for combating tax evasion, the amount of information held on beneficial owners, and the legal framework for exchanging information with local and international authorities.

Then, in June 2022, Malta’s removal from its Financial Action Task Force (“FATF”) list was officially announced.

The global financial watchdog has noted that Malta has made significant progress in implementing the FATF Action Plan. Malta now identifies companies that hide their true owners, imposes more penalties for money laundering, and has improved its business registry. Dozens of effective enforcement actions have been taken against business owners, up from zero previously.

It can be seen that Malta was on the greylist for about a year. That is because they have implemented their action plan. So you can see that there is no single answer for when a country is omitted from the enhanced monitoring. It is always up to the efforts and measures of a country.

Each financial institution should take appropriate measures to identify and assess ML/TF risk factors. Including those related to its customers, countries and geographic areas.

When dealing with clients from high-risk third countries, firms should be aware that:

But of course, this does not mean that customers from high-risk countries are automatically always involved in criminal activity! Rather, they indicate higher risk factors that deserve closer scrutiny.

Companies must assess the risk factors associated with suspicious customer contacts from high-risk countries. To do so, the following must be considered:

Enhanced due diligence is an in-depth review process for high-risk situations (i.e., business with customers from high-risk countries, PEPs, cross-border correspondent relationships with a third country, high transaction amounts, etc.). It requires additional controls, such as verification of the sources of assets and funds.

This enhanced scrutiny does not mean that all customers classified as “high risk” should be automatically blocked. However, they should be required to provide additional information.

DX Compliance is an AML and Compliance firm helping our clients identify, prevent and report financial crime. DX Compliance help Banks, FinTech’s and Payments Providers to continually monitor their risk and detect the threat of money laundering to ensure compliance and reduce fines.

Transaction monitoring also takes into account the countries. This means that the information is checked and compared with the list of high risk countries. If there is a match, an alert is automatically issued for further review.

Furthermore, CheckAML is our ad-hoc PEP and Sanctions & Risk Analysis check tool which can be used for doing Ad-hoc checks on potential clients. That means that it only takes a few seconds to check whether the person or organization is a high-risk country background.

Curious? Please contact our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access