9 November 2022, 14:37

Tagline

9 November 2022, 14:37

Tagline

Fraud is a criminal offense that refers to the intentional deception to obtain an unfair or unlawful gain or to deprive someone of the right to property. It includes, for example, misrepresenting facts through words or conduct, withholding important information, or making false statements to others, thereby causing or potentially causing (financial) or damage.

General criteria of fraud include:

Wire fraud or money transfer fraud involves wire/electronic money transfers that are fraudulent in nature. Often, they are cyber attacks carried out by malicious hacking attacks (malware or viruses). This is how fraudsters get hold of the victim’s credentials and important information, for example, to make fraudulent money transfers.

The fraudulent funds received in the perpetrator’s account are usually quickly drained by cash/check withdrawals or by transfer to another account(s).

In most cases, such incidents are followed by a “recall request” or a so-called “repatriation request” sent by the transferring bank (the victim’s account) to the beneficiary bank (the account of the perpetrator or his accomplice).

Business E-mail Compromise is a type of cyberattack (usually through hacking or phishing) that involves impersonating a company employee to conduct unauthorized transactions. It often starts with exploiting publicly available information or hacking a person’s or organization’s email (spoofing). Other possibilities include deceiving people, such as when fraudsters pose as a supplier or service provider and trick buyers into changing the payee details on their bank account.

Fraudsters are becoming increasingly creative in enticing their targets to share their confidential information in order to gain financial or personal benefits.

Common scam approaches are listed below

This is when fraudsters obtain sensitive information or credentials of the victim either online (phishing) or by phone (vishing).

For phishing attacks, the attacker often creates a fake website or imitates one (for example, financial institution). The victim gets to it by clicking on a malicious link. In the process, all the steps are given for him to follow.

In vishing, the scammers use various methods and social engineering techniques to convince victims to willingly disclose their personal or sensitive information over the phone. E.g., the fraudster calls the victim saying they are from their bank and informs them that there is a problem with their credit card.

On the one hand, forgery is the unlawful alteration of a deed or document with the intent to deceive. This includes, for example, the forgery of a signature and “check forgery,” in which details such as the amount are unlawfully altered, or it may be combined with signature forgery.

On the other hand, forgery is the unlawful imitation of a genuine instrument or document. This includes, for example, identity documents or currencies that have been imitated.

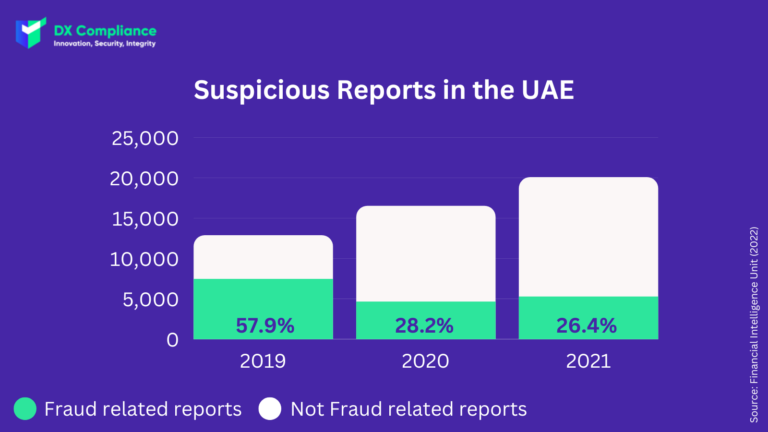

According to the UAE FIU, from 2019 to 2021, they received a total of 49,469 suspicious activity reports. These include Suspicious Transaction Reports (STRS) and Suspicious Activity Reports (SARS).

On the one hand, it is noticeable that there was a significant increase in the total number of STRs and SARS received. But on the other hand, a decrease in reports related to financial frauds in UAE. This is due to raising awareness of fraud in the UAE financial sector, actions taken by law enforcement agencies against those committing the fraud, and quick action to prevent further disbursement of fraudulent funds.

A closer look at the reported financial frauds in UAE reveals the reporting reason selected by the reporting agencies for the fraud-related STRs/SARs. Below are the top three percentages of specific reasons for fraud reports in 2021 in descending order according to FIU UAE records. Together, these three take up the majority.

In addition to reports from the UAE, the FIU also receives M reports from abroad. The UAE FIU received 314 reports from foreign Financial Intelligence Units (FFIUS) on suspicious cases related to possible fraudulent activities from 2019 to 2021.

Moreover, the UAE FIU sent 122 reports to partner country FIUS related to the same issues.

The following is a list of the five most common reasons over the past three years.

DX Compliance is a software-as-a-service (SaaS) and provides a full Real-Time Transaction Monitoring Solution through different combined technologies.

DX aims to help achieve regulatory AML compliance by empowering compliance people in AML. We use technology to help complete their workload with greater speed, reduced costs and allowing the people to focus on the tasks at hand and let us take care of the technological solution. For more information, reach out to us here.

To protect against or identify fraud, we have several solutions for you:

Transaction Monitoring as an efficient and powerful AML system identifies the information by using AI and other AML technologies. In this way, transaction data can be automatically captured and transaction monitoring can be improved. In addition to reducing false alarms, more detailed information is obtained to assess whether a suspicious payment is present.

In addition, CheckAML is our ad hoc customer screening tool with PEP and sanctions and risk analysis checks that can be used for ad hoc reviews of potential customers. This means that only takes a few seconds to check individuals or organizations (customers or suppliers, for example) if there is a risk of fraud.

Curious? Please contact our experts!

On Tuesday, November 29, 2022, an event will be held around the theme “The Road Ahead for DeFi in Abu Dhabi: Where Are We? How far can we go?”

Our Chief Product Officer Prem Ipe will be representing DX Compliance and moderating the panel around compliance and fraud protection for local DeFi and Blockchain projects.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access