6 December 2022, 15:05

Tagline

6 December 2022, 15:05

Tagline

Lithuania has become a popular fintech destination. More and more fintechs and startups have set up store or started parts of their operations in Lithuania.

But how did Lithuania achieve this? Brexit was a shock for many – but for other member states, it was also an opportunity. Lithuania was one of them: While Frankfurt, Paris and Amsterdam vied to lure financial firms away from London, Vilnius sought to attract the world’s FinTechs.

The country’s strategy is based on simplifying regulations. This is to get fintechs to set up their “EU branch” in Lithuania.

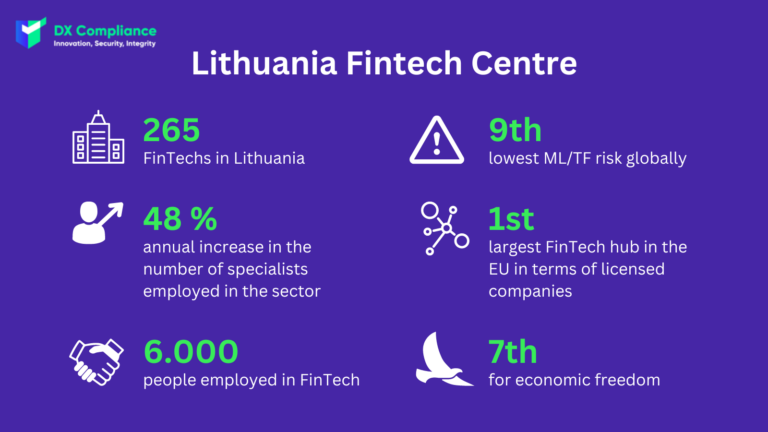

In 2014, there were only 55 FinTechs in Lithuania. Now there are 265. Forty percent of them have their headquarters in other countries.

By continuously improving its business and regulatory environment, Lithuania has strengthened its position as one of the best ecosystems in Europe and the world for developing and rapidly scaling innovative fintech companies.

The law on the prevention of money laundering and terrorist financing includes a number of regulations that must be complied with. Below we have compiled the most important measures that companies must comply with under the Lithuanian AML law:

The AML regulation addresses “financial institutions” and “other obligated entities” that operate or wish to operate in Lithuania. Regulated entities include, in particular:

The Center of Excellence in Anti-Money Laundering was established in May 2021. The center organizes and coordinates cooperation between the public and private sectors. The goal by pooling the experience, knowledge and skills of law enforcement, regulatory and other authorities, as well as representatives of the private sector, we create a safer financial system in Lithuania. It supports the prevention of financial crime brings.

The basic objective is the prevention of financial crime. Associated with this are other sub-objectives, which we have summarized below:

Investment companies, accountants, e-money trading companies, banks, and crowdfunding platforms, among others, are the main industries in Lithuania that are generally considered high-risk. AML regulations apply to these industries. If any of these high-risk sectors fail to comply with AML regulations, criminal sanctions will be imposed.

In addition to the Center of Excellence in Anti-Money Laundering, the following institutions in Lithuania are responsible for combating money laundering and/or terrorist financing: The Government of the Republic of Lithuania, the State Security Service of the Republic, the Lithuanian Financial Crime Investigation Service, the Lithuanian Bank, the Customs Office, the Cultural Heritage Protection Agency affiliated with the Ministry of Culture, the Lithuanian Chamber of Notaries, the Lithuanian Chambers of Justice, the Lithuanian Chamber of Auditors, the Lithuanian Bar Association and the Lithuanian Bureau of Analysis.

Here, we would like to elaborate on the most important ones in a little more detail:

On the one hand, due to, among other things, the fast licensing procedure, the Newcomer Program and the investment and start-up friendly environment, Lithuania is one of the most attractive countries in the EU when it comes to licensing payment and e-money institutions.

On the other hand, Lithuania has made significant progress in combating money laundering and terrorist financing, which underscores the importance of compliance for fintechs looking to set up shop in the country. To truly benefit from this promising fintech hub, companies should ensure that they comply with all current and future regulations that Lithuania introduces.

DX Compliance is an AML and Compliance firm helping our clients identify, prevent and report financial crime. DX Compliance help Banks, FinTech’s and Payments Providers to continually monitor their risk and detect the threat of money laundering to ensure compliance and reduce fines.

Transaction Monitoring as an efficient and powerful AML system identifies the information by using AI and other AML technologies. In this way, transaction data can be automatically captured and transaction monitoring can be improved. In addition to reducing false alarms, more detailed information is obtained to assess whether a suspicious payment is present.

In addition, CheckAML is our ad hoc customer screening tool with PEP and sanctions and risk analysis checks that can be used for ad hoc reviews of potential customers. This means that only takes a few seconds to check individuals or organizations (customers or suppliers, for example) if there is a risk of fraud.

Curious? Please contact our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access