28 July 2022, 14:31

Tagline

28 July 2022, 14:31

Tagline

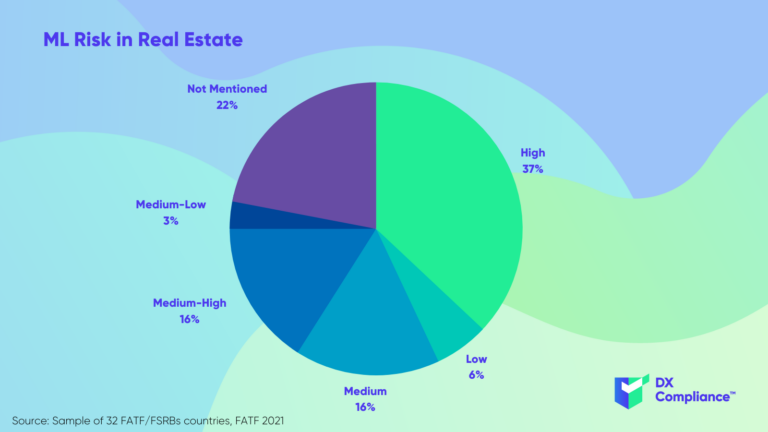

The Real Estate Sector has long been concerned with the potential for corrupt officials and illicit actors to launder the proceeds of criminal activity through the purchase of real estate worldwide as Real Estate is a popular choice for investment, but it also attracts criminals who use real estate in their illicit activities or to launder their criminal profits.

It allows criminals networks to thrive and grow using the profits of their illegal activities, which impacts society and undermines the rule of law.

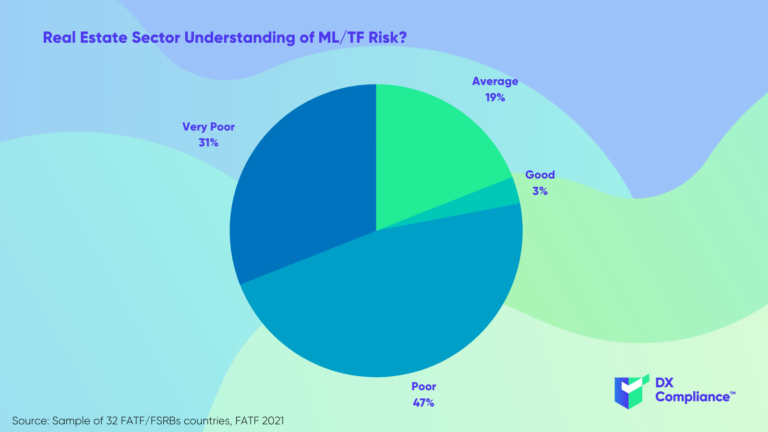

FATF assessments show that the real estate sector often has poor understanding of these risks and regularly fails to mitigate them. The revised Risk-Based Approach Guidance for the Real Estate Sector highlights the importance for the sector to increase its understanding of the money laundering and terrorist financing risks it faces.

Vulnerabilities include exploitation by politically exposed persons, the purchase of luxury real estate, the use of virtual assets, the use of anonymous companies and gatekeepers as instruments to launder the proceeds of crime.

The sector needs to take appropriate measures to adequately mitigate these risks. This includes effective customer due diligence measures.

The FATF has updated its guidance for a risk-based approach for the real estate sector with input from the private sector, including through a public consultation in March-April 2022.

Given the relative stability of the real estate sector as store of value, and worldwide gaps in industry regulation, many real estate markets continue to be used as a vehicle for money laundering.

Real estate transactions involving loans or other financing by regulated financial institutions, such as banks, which are subject to federal anti-money laundering rules, are less susceptible to money laundering because those institutions are required to report suspicious activity to the authority.

For example, when most families buy a home with a mortgage, the bank that makes the loan is subject to rules that require it to identify the buyer and report suspicious activity.

In contrast, when real estate is purchased without such financing, it can be nearly impossible to trace the beneficial owners behind shell companies that are often used to purchase the real estate. As a result, corrupt officials and criminals engaging in illicit activity can exploit the real estate sector to launder money.

Money laundering is how criminals change money and other assets into clean money or assets that have no obvious link to their criminal origins.

Money laundering can take many forms, but in the property and real estate sector it is involving mostly in 4 ways:

1. Buying a property and using the proceeds of crime, letting it or selling it on, giving the criminal an apparently legitimate source of funds.

2. Criminals hiding behind complex company structures involving multiple countries and multiple bank accounts to disguise the real purpose of a transaction and hide its beneficial ownership.

3. A more direct method of paying an estate agency business or lettings agent a large amount and reclaiming it later.

4. The money for a purchase resulting from financial crime or other fraud operation.

In sum, the real estate sector is prone to abuse and can assist criminals in their illicit activities or the laundering of criminal profits.

A previous FATF report identified and summarised several activities of money laundering via the real estate sector. This Guidance adds to these typologies to include:

• Use of complex loans or credit finance

• Use of non-financial professionals

• Use of corporate vehicles or complex structures

• Unexplained use of virtual assets

• Manipulation of the appraisal or valuation of a property

• Use of monetary instruments

• Unexplained cash payments

• Use of client accounts

• Construction and renovation of real estat

• Use and purchase of commercial properties inconsistent with business purpose.

In order to perform a risk-based approach you need to apply CDD + EDD.

You must carry out customer due diligence on your customer and the counterparty of the transaction. The level of due diligence will depend on your risk assessment of each person in line with your overall risk assessment.

With CheckAML our Instant AML checks allow you to screen your clients against global & local PEP and Sanctions lists instantly and to perform risk assessments on individuals and entities within a few minutes.

Real estate professionals must understand how the business could be exposed to ML/TF risks and ensure that systems are designed and implemented to deal with these risks.

A risk assessment will aid in identifying the ML/TF risks the business is potentially exposed to during the course of its activities.

A documented risk assessment should include current and emerging ML/TF trends while considering how such issues may impact the business. The risk assessment should be kept up to date. It needs to include:

• Geographical risks, such as the areas of operation and those countries identified by FATF or other regional and national authorities as high-risk.

• Customer risks including particular attention to any additional parties in a transaction and any underlying beneficial owners.

• Transaction risks including the methods of financing and delivery channels.

DNFBPs involced in Real Estate like Real Estate agents in particular, and when linked to the buying and selling of real estate.

Details of the customer due diligence must be kept sometimes for many years. This is where CheckAML can help you.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access