7 November 2022, 12:00

Tagline

7 November 2022, 12:00

Tagline

Like other financial industries, FinTech companies can face criminal offenses such as money laundering if they fail to comply with regulations (including FAFT). Therefore, regulators can impose severe sanctions such as fines and disciplinary actions. Furthermore, money laundering in FinTech companies leads to severe reputational losses, which result in unpleasant consequences.

On the other hand, one crucial point should be noted: Traditional methods are usually not enough for FinTech companies to comply with AML regulations, so FinTech companies should prefer technology-compatible AML solutions.

FinTech services in the financial sector have brought undeniable benefits to the industry and customers. Among others, through digital transformation FinTech is growing and evolving day by day. But as FinTech grows, money laundering (AML) concerns are also developing.

In FinTech, money laundering is attractive to criminals because of the large number of transactions in these systems, the unlimited flow of money, and the handling of anonymous accounts. This makes money laundering easier for criminals.

Moreover, electronic money laundering (transaction laundering) has begun to replace traditional money laundering. This case shows that FinTech is a potential target for criminal organizations to launder money. As a result of all this data, FinTech companies may be exposed to serious AML risks.

Anonymity: Because Fintech products and services are accessed over the Internet, money launderers may provide incomplete, misleading, or false information to mask their identities and evade AML controls.

Transaction speeds: The increasing speed of Internet connections means that money launderers can transfer large amounts of money to and from accounts or between different institutions in a short period of time, thereby evading regulatory controls.

Cross-border transactions: Fintech services can be accessed anywhere to transfer funds between accounts in different countries, allowing criminals to transfer illicit funds to higher-risk countries where AML controls are less or less stringent.

Regulatory lag: the novelty and innovation of fintech services often outstrips the ability of financial regulators to crack down on illicit activity, creating vulnerabilities and blind spots.

Finding known and unknown financial crime patters is a huge challenge and graph database technology lacks sufficient expressive power to capture many known financial crime patterns. Perhaps using generalised patterns and industry pattern detection, modelled in the form of reasoning rules of the intentional component is a step in the right direction.

The world is uncertain, raw data can be unclear, criminal behaviour is often unknown. A successful rule-based approach based on sophistication and usability of language and its performance in encoding real-world cases with a high level of effectiveness will be useful.

With the ever-present threat of financial crime, internal and external information integration is critical. Moreover, the approach should support important properties, such as IT independence, decoupling critical tasks from specific programming languages, correctness and others, thanks to the adoption of a semantically unambiguous formalism and sophistication.

New financial crime and anti-money laundering (AML) concerns across the globe and the emphasis on regulatory oversight means that financial institutions cannot lose focus on the critical responsibility to detect, investigate, and report suspicious activity. At the same time, institutions are being pushed to explore ways to deploy better technology to keep pace with fraudsters and money launderers. Financial institution financial crime and fraud groups have radically changed how they work; no longer in offices collaborating on investigations, sharing information, and learning from one another but working by themselves at home.

FinTechs should focus on tighter controls and interoperable software systems. While many end-to-end financial crime software applications exist, not all are on a single system for TM to case management and reporting. Firms should start focusing on integrating and building new technology which align with regulation and user friendly. As COVID-19 fades and AML teams return to offices, focus should be on AI, quality recruitment and training.

The speech by FCA CEO, Nikhil Rathi and the FCA’s Business Plan 21/22 means FinTechs should keep an eye on:

DX Compliance has explored the issues faced within FinTechs and have created an action plan we recommend for the most effective solutions.

Have a forward-looking strategy for financial crime compliance, using sophisticated, user friendly and effective technology and regulatory innovation within FinTech. Apply new technologies on the FinTech landscape, and also technology that has been utilised in an innovative way, such as AI and Machine Learning solutions, to help uncover financial crime more effectively. Finding new ways to prevent financial crime with the right blend of technology and regulatory innovation is key to the strategy.

By employing robust practical on the job training programme that is applicable and easy to understand will benefit the company. It is important to create rules to reduce false positive alerts and aligning regulatory metrics effectively.

Financial market intelligence to build global positive perception and build the right culture, tone at the top, middle and frontline whilst employing data analytics to build trust transparency.

Through our discussion with two compliance experts in our Digital Series we have come up with the following practical tips for Compliance Officers in Fintech. These are as follows:

Build regulation into your technology solution creates cooperation between your IT, compliance and business analysis. Algorithms that treat customers fairly is important to implement.

It is important to learn from others’ mistakes, such as having appropriate detectors for malware puts a stop gap in straight through processing for analysis and prevent payment fraud. Also, building clear lines of categorisation for client types allows for more efficient operations. As part of end-to-end processing ensures identity verification – name matching before transaction processing.

It is vital to complete business risk assessments ensuring detail on risks are adequate and demonstrate evidence of control strength. Consider customers, geographical location, products and services, transactions and delivery channels.

Understanding the differences between financial crimes including AML/Terrorist Financing/Fraud/Bribery and Corruption/Tax Evasion relating to your products and services removes ambiguity. An aspirational state of customer risk management implements mechanisms preventing loss of customers and promote loyalty. Utilising big data effectively will impact the success of your AML compliance in FinTech.

Ensure to train staff on the end-to-end processes following clear and simple steps. Focus on real life scenarios to improve their knowledge and skills. It is also impactful to draw on existing staff skill strength before proceeding to recruit and focus on practical analytical skill set not just theoretical.

Ensure to create a compliance culture within your organisation. This begins with the tone from the top management levels and travels to the middle and bottom. Using Management Information to assess your risk and prioritise for effective resourcing will improve your operations.

Through our discussion with two compliance experts in our Digital Series we have come up with the following general practical tips for Fintechs to succeed.

Clearly articulate the purpose and nature of relationship; link expected and actual activity; effectively differentiate between source of funds and wealth and document analysis carried out accordingly. This is becoming increasingly difficult as we enter global world; big vs small (Amazon/Paypal)

Understand your customer’s financial behaviour/pattern; set effective bespoke and structured thresholds and scenarios in line with expected activities stated by customer. Understand the technological architecture of your transaction monitoring system and perform regular assessments of data feeds / integrity. Investigate TM alerts using due diligence already undertaken as well as external sources if necessary and document discounting rationale to validate decision to proceed with or abort transaction.

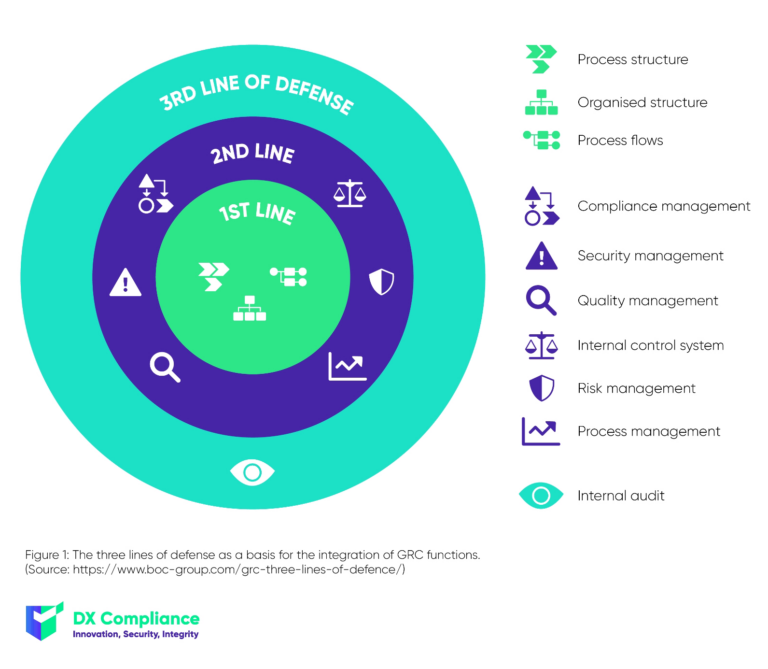

Utilise three lines of defence and ensure there are no blurred lines between the first and second lines of defence, noting where second line are undertaking what may be deemed a first line activity – and the resultant reduction in first line financial crime risk ownership.

Dx Compliance is a full solution Transaction Monitoring through different combined technologies. We provide our software to financial institutions with the company in mind and offer in-depth and industry proven experience for many types of companies around the globe. DX aims to help achieve regulatory AML compliance by empowering compliance people in FinTech. We solve the problems explored in this blog by working with AML compliance officers in FinTech and using technology to help complete their workload.

Find out more about DX Compliance solutions here.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access