27 September 2022, 16:30

Tagline

27 September 2022, 16:30

Tagline

AML compliance is one of the greatest challenges for the legal sector. The financial crime in the digital age is characterized by complex interconnections and undefined geographies. Thus, legal firms have to comply with global legal and regulatory frameworks, anti-money laundering guidelines, and sanctions.

This is a challenging environment which can be highlighted by exemplary incidents:

Especially in Europe, anti money laundering guidance for the legal sector started to become important following the implementation of the 5th anti-money laundering Directive. These amendments introduced substantial improvement to better equip the Union to prevent the financial system from being used for money laundering and for funding terrorist activities.

But manual AML checks can be an expensive, time-consuming task. In addition, manual checks can often prove inaccurate, as they’re open to human error and cost-ineffective. This is why we provide a legal sector AML guidance to help you to comply in a simple way.

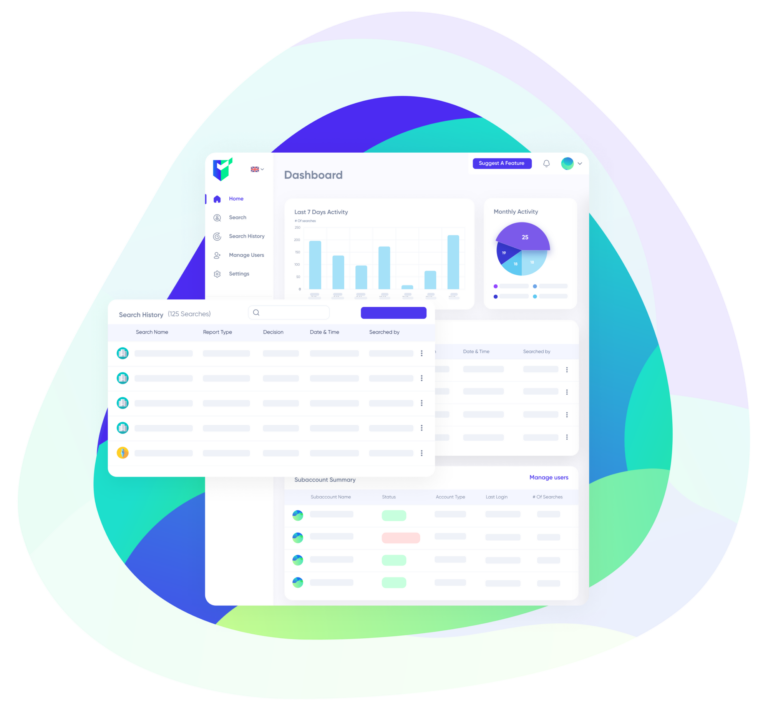

CheckAML is the most efficient and cost-effective way of carrying out money laundering checks for the legal sector. This is why this is the core of the legal sector AML guidance.

We offer the only instant AML solution with full PEP & sanctions screening, ongoing monitoring and customer risk assessment worldwide. This helps to ensure Client Due Diligence for legal practices.

Our data and coverage is global, real-time and reliable, all your checks are automatically saved, for audits and regulatory visits. So everything you need we’ve got you covered.

PEP (Politically exposed Person) is not in all jurisdictions defined in the same way. But in general, it is a person who serves in a high-ranking political position.

Politically exposed Persons (PEPs), their family members and their known close associates may present a higher risk than non-PEPs as they may be at greater risk of abusing public office for private gain and further. A PEP may use the services of the legal sector to launder the proceeds of this abuse of office.

Screening for PEP is mandatory. The regulations require legal firms to have in place appropriate risk-management systems and procedures to determine whether a client is a PEP (or a family member or a known close associate of a PEP). It has to manage the risks arising from the firm’s relationship with those clients. There are many legitimate reasons for doing so (e.g., a solicitor acting in a property transaction).

With CheckAML, instant PEP checks are possible. You simply screen of a name against a database of over 1 million PEPs around the world. This is how to find out whether the person is a PEP or not – in seconds.

Within the sanction screening, you can check for targeted financial sanctions (TFS). This means that such sanctions are imposed against specific individuals or groups, or undertakings or entities. The term includes both asset freezing and prohibitions to prevent funds or other assets from being made available, directly or indirectly, for the benefit of individuals, entities, groups, or organization who are sanctioned.

Financial institutions and DNFBPs are obliged to apply policies, procedures and controls to implement TFS to those sanctioned and referred in the UN List and the Local Terrorism List. This is why it is an important part of the legal sector aml guidance.

Moreover, it saves and protects your reputation as you perform on your customers the necessary Due Diligence and Enhanced Due Diligence.

Also for the sanction check, you screen of a name against a database. To ensure global compliance, we screen over 400 of lists around the globe, including:

The aim of a client risk assessments is to identify and assess the money laundering (ML) and/or terror financial (TF) risks identified at individual client level.

Therefore, the Risk Based Approach is important to implement in your organization. As a core principle of AML compliance the so called risk-based approach (RBA) refers to adjusting the level and type of compliance work done (frequency, intensity and/or amount), to the risks present.

When assessing client risk factors, you should consider your client base first. In order to apply an RBA, it is necessary then to have information on the risks inherent to your practice and in any particular client or matter. Identification of the ML/TF risks associated with certain clients or categories of clients, and certain types of work will allow you to determine proportionate controls to mitigate them. Factors which may affect the level of risk associated with your client base.

If you have not fully assessed the risks present across your business or in any particular client or matter, you cannot then apply appropriate controls to mitigate those risks adequately and effectively.

Generally speaking, a single factor may not automatically make a matter or client high risk in and of itself, exceptions include where a client or counterparty is based in a high risk third country or is a PEP. It should be all the risk factors taken together that informs whether a matter or client is deemed to be high risk.

With our product CheckAML you can perform Risk Assessments on Clients in seconds. A comprehensive risk assessment is visualized. Each risk factor is evaluated and color-coded on a scale. The weighting of the risk factors can even be adjusted individually!

The resulting benefits of this approach include:

Your initial risk assessment should always be performed at the beginning of a client relationship in conjunction with performing CDD. However, for some clients, additional information to inform the risk profile may only emerge once further information becomes available or the relationship/matter progresses.

You must keep records of a risk assessment for every client you act for as a part of your CDD.

For that, you can easily download a PDF report for every risk assessment in CheckAML.

The ability to conduct Customer Due Diligence (CDD) in an automated way, enables the legal sector to use compliance as a competitive advantage rather than just a cost centre. Legal firms are keen to adopt new technology against ML or TF risks.

If you are a legal firm and interested in buying technology we recommend you document the role of the tool, the data sources it uses, and in what circumstances (clients/matters). Based on that you will find the right tool for your organization.

The future of compliance in the legal industry and the legal service industry is client centric where compliance is an Innovation driver and not a cost-center. It saves what matters most: the reputation of your law firm. Therefore, we present the technological solution CheckAML within the legal sector AML guidance

The Client onboarding experience is important for legal firms as it is for financial institutions and other industries.

Compliance and AML regulation should not disturb the experience but performing a risk based approach is necessary to demonstrate that regulation is not just a word. The Compliance mind-set at the onboarding can be your competitive advantage in terms of how the process works and how you use tech to utilise it.

Firms of the legal industry need a data driven customer centric approach therefor the CDD, EDD and Onboarding Experience is crucial. Use data the right way.

Digital Transformation is key for law firms to reach the new clients and to cope with the tech savvy generations. As it is crucial to get the onboarding of a Client right, so is to apply AML and Compliance driven approaches right at the beginning as well as on an ongoing base.

The penalties for money laundering crimes include fines ranging from Dh50,000 to Dh5 million, and can also include the suspension and cancellation of licenses.

The Ministry of Justice has called upon registered lawyers to access the “Smart Lawyer” system on the Ministry website and to appoint a compliance officer for each office.

AML Compliance is still a hard task for the legal sector as the regulations and the complexity of financial crime increase in the digital age. But staying comply is still a huge challenge for many institutions.

Thus, the core of the Legal Sector AML Guidance is CheckAML. With that product, firms of the legal industy can perform AML checks in seconds. The simple way covers the screening of people or businesses against huge platforms.

Stay compliant with CheckAML. Curious to learn more? Feel free to get in touch with our experts.

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access