10 January 2023, 11:06

Tagline

10 January 2023, 11:06

Tagline

Web 3.0, also known as the Semantic Web, is the next generation of the internet. It is a vision of a future internet in which data is more interconnected and machine-readable, enabling more intelligent and intuitive computing. The goal of Web 3.0 is to create a more intelligent and interconnected internet that can better understand the meaning and context of information, allowing for more personalized and effective search results and recommendations.

Anti-Money Laundering (AML) and Web 3.0 may seem like unrelated topics, but they are actually closely connected. The rise of digital currencies and decentralized finance (DeFi) has made it easier for criminals to launder money and evade detection. Web 3.0 technologies, such as blockchain and smart contracts, have the potential to revolutionize AML by providing more transparent and secure financial transactions. This could potentially make it easier to detect and prevent money laundering, as all transactions on a blockchain are recorded and publicly available. This also makes it more difficult for criminals to conceal their tracks.

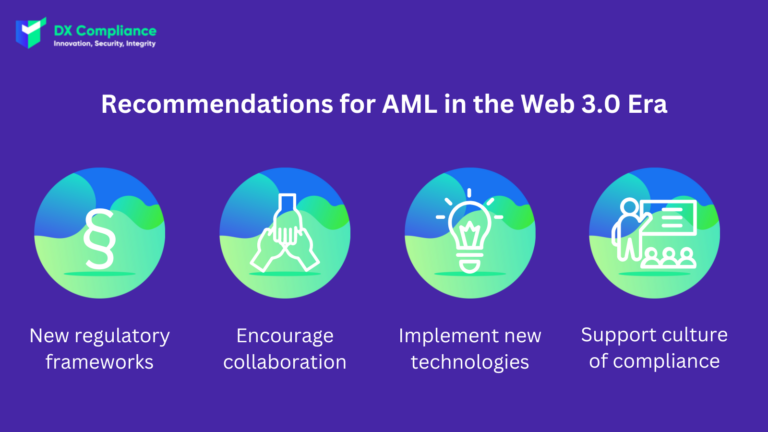

As the use of blockchain and digital assets becomes more widespread, it will be important to develop new regulatory frameworks that are specifically designed to address the unique challenges and risks posed by these technologies. This could include guidelines for customer identification, transaction monitoring, and reporting suspicious activity.

Regulators, financial institutions, and technology companies should work together to develop and implement effective AML measures for the digital era. This could include sharing information and best practices, as well as jointly developing new technology solutions.

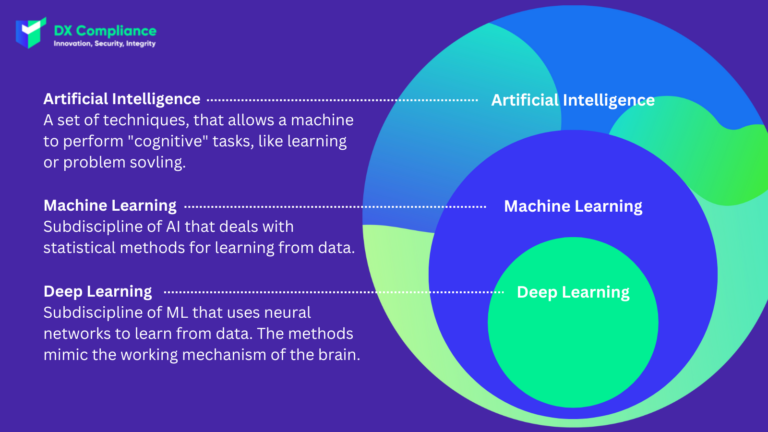

Financial institutions should explore and implement new technologies, such as artificial intelligence and machine learning algorithms, to help detect and prevent money laundering in the digital era.

Financial institutions should encourage and support a culture of compliance, by providing training, providing clear guidelines and also create a compliance department to ensure all the employees are aware of the AML laws and regulations and are taking the necessary measures to comply with them.

DX Compliance offers software solutions that aim to help financial institutions and other organizations comply with anti-money laundering and other regulatory requirements in the digital era, including the Web 3.0 era.

The Transaction Monitoring System uses artificial intelligence (AI) and machine learning algorithms to identify suspicious activities. The system can analyse large amounts of data from various sources, such as blockchain transactions, and flag potential instances of money laundering, fraud or other illicit activities.

DX Compliance can help financial institutions to navigate the complex regulatory landscape of the digital era to comply with laws and regulations.

Curious? Please contact our experts!

08.08.2022

An overview of recent AML developments in the UAE.

Get access

15.10.2021

The introduction of 6AMLD regulations aims to reduce financial crimes.

Get access

27.07.2021 AML Compliance

Uncovering the PEP and Sanctions Lists and Global Regulation

Get access